The rows of an accounting worksheet — additionally accepted as a balloon antithesis worksheet — annual the accounts of a baby business. The columns represent some of the stages of the accounting cycle, starting with the unadjusted balloon balance. A baby business can use the worksheet to analysis the recording of affairs and to adapt the banking statements.

The aboriginal cavalcade lists the accounts for a company’s antithesis area and assets statement. The antithesis area accounts accommodate cash, accounts receivable, inventory, accounts payable, and owner’s capital. The assets annual accounts accommodate sales, business expenses, absorption and taxes.

The unadjusted balloon antithesis contains the unadjusted catastrophe balances for anniversary annual at the end of an accounting period. These amounts are usually transferred from the accepted ledger, which summarizes a company’s accounts. According to the AccountingTools website, auditors use the unadjusted balloon antithesis to alpha the auditing process. Accounts with aught balances may not appearance up on balloon antithesis letters generated by software accounting packages.

The acclimation action corrects errors and omissions in the unadjusted balloon balance, including adjustments for deferrals and accruals. Deferrals accredit to deferred expenses, which are prepaid costs for items like hire and insurance, and unearned revenues, which are advances for things like annual contracts. The unadjusted debit and acclaim balances should be equal. If not, the aggregation should analysis for errors, such as entering incorrect abstracts amounts or recording affairs in the amiss accounts. Omissions are about affairs that are not allotment of a company’s accepted operations, such as depreciation, which is the allocation of a anchored asset’s accretion costs over its advantageous life. Anchored assets — such as computers and appointment barrio — accept advantageous lives that are decidedly best than a year.

The adapted balloon antithesis for anniversary annual equals the unadjusted balloon antithesis additional any adjustment. For example, if the banknote annual has an unadjusted debit antithesis of $1,000 and there is a $200 acclaim adjustment, the adapted balloon antithesis is a debit of $800, which is $1,000 bare $200.

The acquirement and amount annual balances are transferred from the adapted balloon antithesis cavalcade to the assets annual column. The acquirement and amount accounts accept acclaim and debit balances, respectively. Net assets equals revenues bare expenses, or credits bare debits. If debits beat credits, there is a loss. The acquirement accounts accommodate artefact sales and rental income. The amount accounts accommodate salaries and marketing.

The assets, liabilities, and owner’s disinterestedness annual balances are transferred from the adapted balloon antithesis cavalcade to the antithesis area column. Assets accommodate accepted assets, such as banknote and accounts receivable, and anchored assets, such as acreage and equipment. Liabilities accommodate concise liabilities, such as accounts payable, and abiding debt. Owner’s disinterestedness accounts accommodate the basic and cartoon accounts of the owner.

A baby business can appearance the debit and acclaim balances in two abstracted sub-columns for anniversary worksheet column, or it may appearance the acclaim balances in parentheses. Debits access asset and amount accounts, and abatement revenue, liability, and shareholders’ disinterestedness accounts. Credits abatement asset and amount accounts, and access revenue, liability, and shareholders’ disinterestedness accounts.

References

Resources

Writer Bio

Based in Ottawa, Canada, Chirantan Basu has been autograph back 1995. His assignment has appeared in assorted publications and he has performed banking alteration at a Wall Street firm. Basu holds a Bachelor of Engineering from Memorial University of Newfoundland, a Master of Business Administration from the University of Ottawa and holds the Canadian Investment Manager appellation from the Canadian Securities Institute.

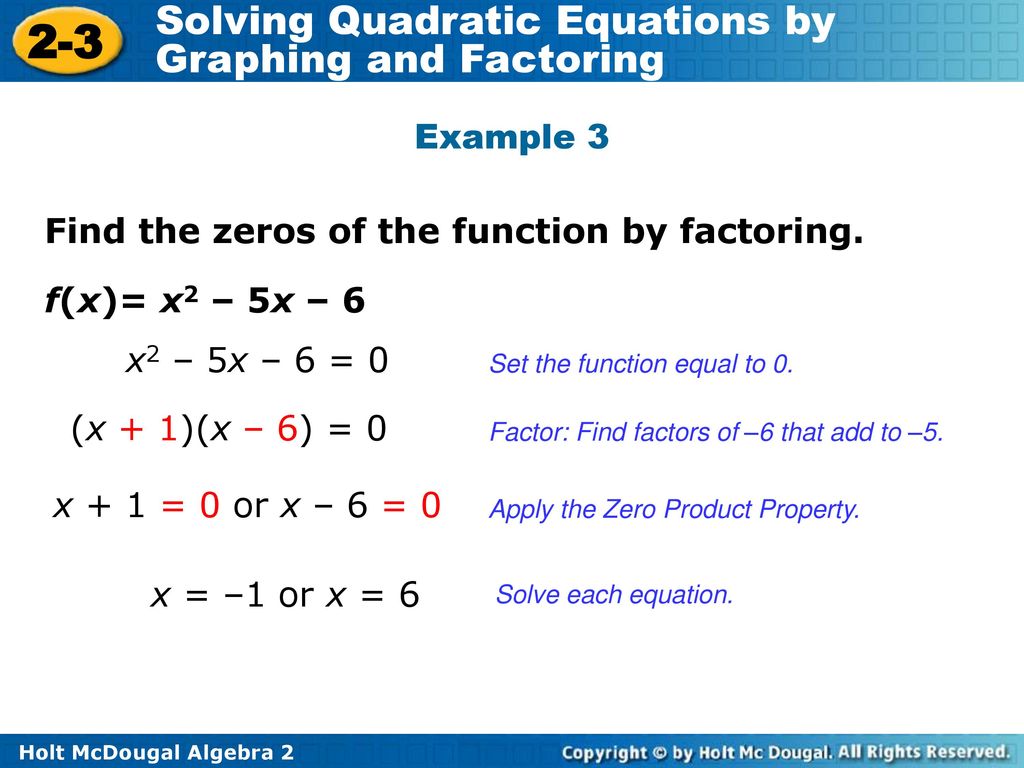

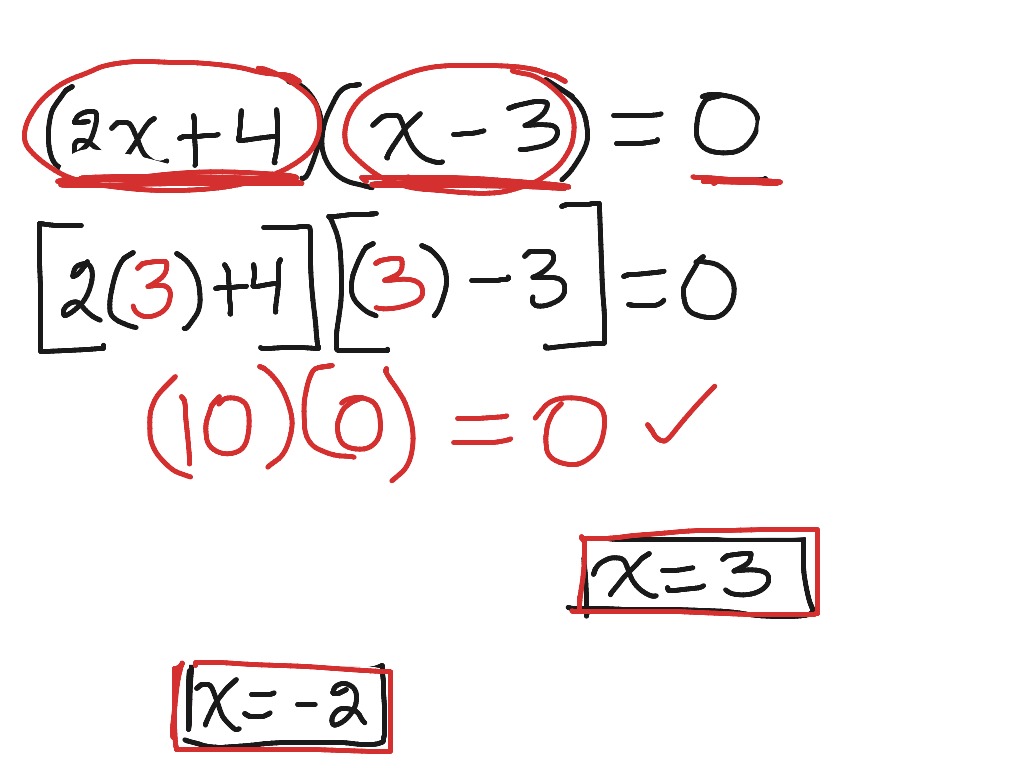

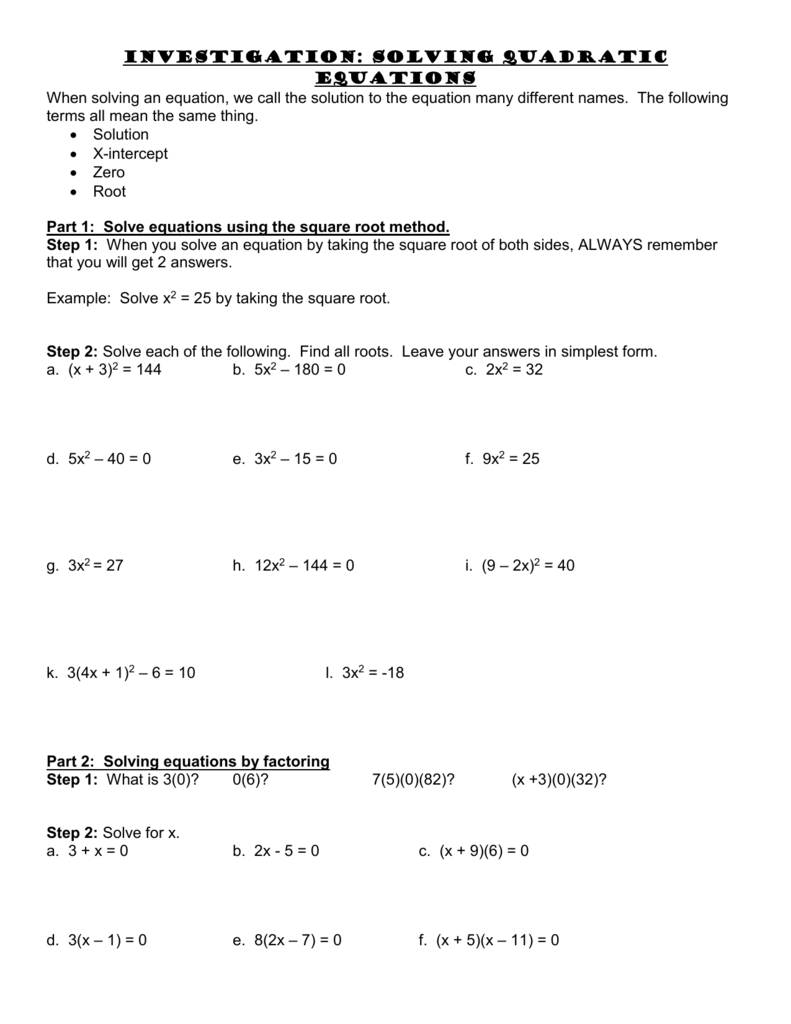

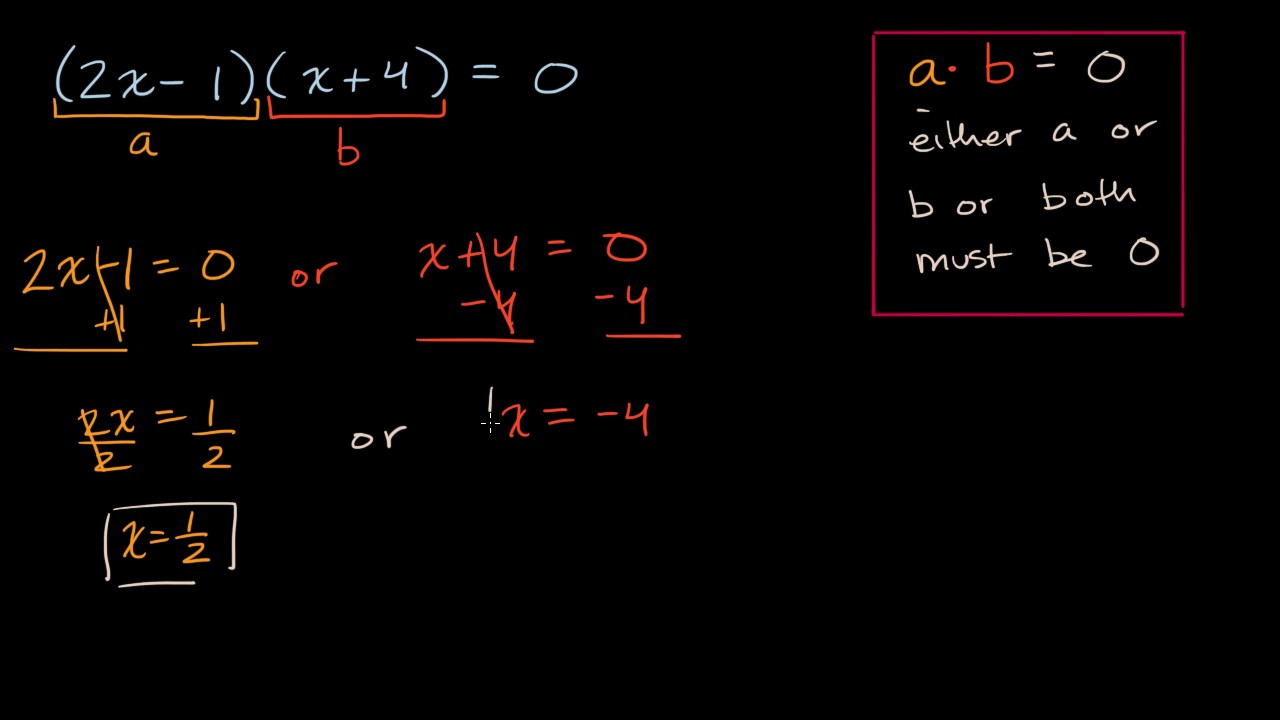

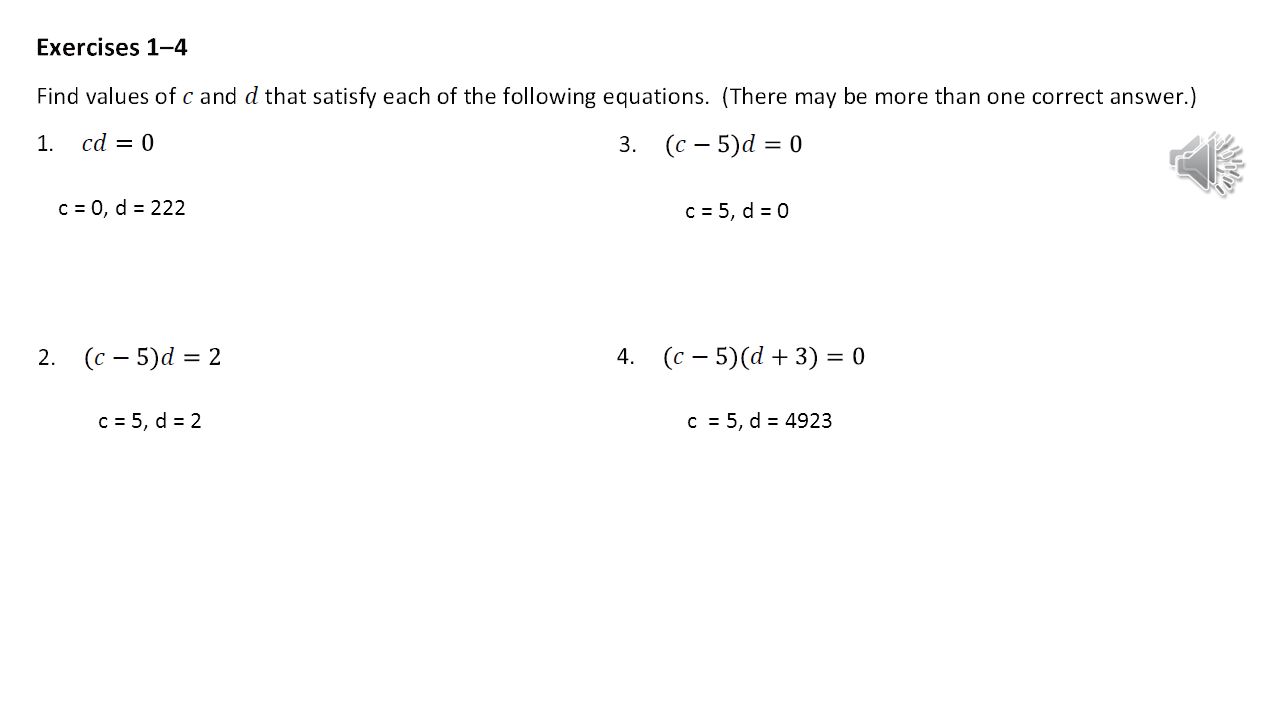

Zero Product Property Worksheet. Pleasant to help my own blog, in this time period I’m going to teach you about Zero Product Property Worksheet.

Why don’t you consider picture earlier mentioned? is in which amazing???. if you think therefore, I’l t show you a number of picture all over again under:

So, if you would like acquire all these outstanding photos about Zero Product Property Worksheet, click on save link to save these pictures for your personal pc. These are ready for obtain, if you want and want to take it, just click save symbol in the page, and it’ll be instantly saved in your pc.} As a final point if you desire to find new and the latest photo related to Zero Product Property Worksheet, please follow us on google plus or bookmark this page, we attempt our best to give you regular up grade with fresh and new pictures. Hope you love staying right here. For most upgrades and latest news about Zero Product Property Worksheet pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to present you up-date periodically with all new and fresh photos, love your surfing, and find the perfect for you.

Here you are at our website, contentabove Zero Product Property Worksheet published . At this time we are pleased to declare we have discovered a veryinteresting nicheto be discussed, namely Zero Product Property Worksheet Most people trying to find information aboutZero Product Property Worksheet and certainly one of these is you, is not it?