An assets anniversary is one of the three important banking statements acclimated for advertisement a company’s financial performance over a specific accounting period, with the added two key statements actuality the antithesis sheet and the anniversary of cash flows.

Also accepted as the accumulation and accident anniversary or the anniversary of acquirement and expense, the assets anniversary primarily focuses on the company’s revenues and costs during a accurate period.

The assets anniversary is an important allotment of a company’s achievement letters that charge be submitted to the Securities and Barter Commission (SEC). While a antithesis area provides the snapshot of a company’s financials as of a accurate date, the assets anniversary letters assets through a accurate time aeon and its heading indicates the duration, which may apprehend as “For the (fiscal) year/quarter concluded September 30, 2018.”

The assets anniversary focuses on four key items—revenue, expenses, gains, and losses. It does not differentiate amidst banknote and non-cash receipts (sales in banknote against sales on credit) or the banknote against non-cash payments/disbursements (purchases in banknote against purchases on credit). It starts with the accommodation of sales, and afresh works bottomward to compute the net income and eventually the earnings per allotment (EPS). Essentially, it gives an anniversary of how the net revenue realized by the aggregation gets adapted into net balance (profit or loss).

The afterward are covered in the assets statement, admitting its architecture may alter depending aloft the bounded authoritative requirements, the adapted ambit of the business and the associated operating activities:

Revenue accomplished through primary activities is generally referred to as operating revenue. For a aggregation accomplishment a product, or for a wholesaler, benefactor or banker circuitous in the business of affairs that product, the acquirement from primary activities refers to acquirement accomplished from the auction of the product. Similarly, for a aggregation (or its franchisees) in the business of alms services, acquirement from primary activities refers to the acquirement or fees becoming in barter of alms those services.

Revenues accomplished through secondary, non-core business activities are generally referred to as non-operating alternating revenues. These revenues are sourced from the balance which are alfresco of the acquirement and auction of appurtenances and casework and may accommodate assets from absorption becoming on business basic lying in the bank, rental assets from business property, assets from cardinal partnerships like ability acquittal receipts or assets from an advertisement affectation placed on business property.

Also alleged added income, assets announce the net money fabricated from added activities, like the auction of abiding assets. These accommodate the net assets accomplished from ancient non-business activities, like a aggregation affairs its old busline van, bare land, or a accessory company.

Revenue should not be abashed with receipts. Acquirement is usually accounted for in the aeon back sales are fabricated or casework are delivered. Receipts are the banknote accustomed and are accounted for back the money is absolutely received. For instance, a chump may booty goods/services from a aggregation on 28 September, which will advance to the acquirement actuality accounted for in the ages of September. Owing to his acceptable reputation, the chump may be accustomed a 30-day acquittal window. It will accord him time till 28 October to accomplish the payment, which is back the receipts are accounted for.

The amount for a business to abide operation and about-face a accumulation is accepted as an expense. Some of these costs may be accounting off on a tax acknowledgment if they accommodated the IRS guidelines.

All costs incurred for earning the accustomed operating acquirement affiliated to the primary action of the business. They accommodate the amount of appurtenances awash (COGS), selling, accepted and authoritative costs (SG&A), abrasion or amortization, and analysis and development (R&D) expenses. Typical items that accomplish up the anniversary are agent wages, sales commissions, and costs for utilities like electricity and transportation.

All costs affiliated to non-core business activities, like absorption paid on accommodation money.

All costs that go arise a loss-making auction of abiding assets, ancient or any added abnormal costs, or costs arise lawsuits.

While primary acquirement and costs action insights into how able-bodied the company’s amount business is performing, the accessory acquirement and costs anniversary for the company’s captivation and its ability in managing the ad-hoc, non-core activities. Compared to the assets from the auction of bogus goods, a substantially high-interest assets from money lying in the coffer indicates that the business may not be utilizing the accessible banknote to its abounding abeyant by accretion the assembly capacity, or it is adverse challenges in accretion its bazaar allotment amidst competition. Alternating rental assets acquired by hosting billboards at the aggregation branch anchored forth a artery indicates that the administration is capitalizing aloft the accessible assets and assets for added profitability.

Mathematically, the Net Assets is affected based on the following:

Net Assets = (Revenue Gains) – (Expenses Losses)

To accept the aloft accommodation with some absolute numbers, let’s accept that a apocryphal sports commodity business, which additionally provides training, is advertisement its assets anniversary for the best contempo quarter.

It accustomed $25,800 from the auction of sports appurtenances and $5,000 from training services. It spent assorted amounts as listed for the accustomed activities that absolute $10,650. It accomplished net assets of $2,000 from the auction of an old van, and incurred losses anniversary $800 for clearing a altercation aloft by a consumer. The net assets comes to $21,350 for the accustomed quarter. The aloft archetype is the simplest forms of the assets anniversary that any accepted business can generate. It is alleged the Single-Step Assets Anniversary as it is based on the simple adding that sums up acquirement and assets and subtracts costs and losses.

However, real-world companies generally accomplish on a all-around scale, accept adapted business segments alms a mix of articles and services, and frequently get circuitous in mergers, acquisitions, and cardinal partnerships. Such advanced arrangement of operations, adapted set of expenses, assorted business activities, and the charge for advertisement in a accepted architecture as per authoritative acquiescence leads to assorted and circuitous accounting entries in the assets statement.

Listed companies chase the Multiple-Step Assets Anniversary which segregates the operating revenues, operating expenses, and assets from the non-operating revenues, non-operating expenses, and losses, and action abounding added accommodation through the assets statement. Essentially, the different measures of advantage in a multiple-step assets anniversary are arise at four altered levels in a business’ operations – gross, operating, pre-tax and after-tax. As we shall anon see in the afterward example, this allegory helps in anecdotic how the assets and advantage are moving/changing from one akin to the other. For instance, aerial gross accumulation but lower operating assets indicates college expenses, while college pre-tax accumulation and lower post-tax accumulation indicates accident of balance to taxes and added one-time, abnormal expenses.

Let’s attending at the best contempo anniversary assets statements of two large, publicly-listed, bunch companies from altered sectors of Technology (Microsoft) and Retail (Walmart).

Image by Sabrina Jiang © Investopedia 2020

The focus in this accepted architecture is to anniversary the profit/income at anniversary subhead of acquirement and operating costs and afresh anniversary for binding taxes, interest, and added non-recurring, ancient contest to access at the net assets that is applicative to accepted stock. Admitting calculations absorb simple additions and subtractions, the adjustment in which the assorted entries arise in the anniversary and their relations generally gets repetitive and complicated. Let’s booty a abysmal dive into these numbers for bigger understanding.

The aboriginal area blue-blooded “Revenue” indicates that Microsoft’s Gross (annual) Accumulation for the budgetary year catastrophe June 30, 2018, was $72.007 billion. It was accustomed at by deducting the amount of acquirement ($38.353 billion) from the absolute acquirement ($110.360 billion) accomplished by the technology behemothic during its budgetary year. About 35% of Microsoft’s absolute sales went against costs for acquirement generation, while a agnate amount for Walmart was about 75% ($373.396/$500.343). It indicates that Walmart incurred abundant college amount compared to Microsoft to accomplish agnate sales.

The abutting area alleged “Operating Expenses” afresh takes into anniversary the amount of acquirement ($38.353 billion) and absolute acquirement ($110.360 billion) to access at the arise figures. As Microsoft spent $14.726 billion on analysis and development (R&D) and $22.223 billion on Affairs Accepted and Authoritative Amount (SG&A) the Absolute Operating Expenses is computed by accretion all these abstracts ($38.353 $14.726 $22.223) = $75.302 billion.

Reducing the absolute operating costs from absolute acquirement leads to Operating Assets (or Loss) as ($110.360 – $75.302) = $35.058 billion. This amount represents the Balance Before Absorption and Taxes (EBIT) for its amount business activities and is afresh acclimated after to acquire the net income.

A allegory of the band items indicates that Walmart did not absorb annihilation on R&D, and had college SGA and absolute operating costs compared to Microsoft.

The abutting area blue-blooded “Income from Continuing Operations” adds net added assets or costs (like one time earnings), interest-linked costs and applicative taxes to access at the Net Assets From Continuing Operations ($16.571 billion) for Microsoft, which is 60% college than that of Walmart ($10.523 billion).

After discounting for any non-recurring events, the amount of net assets applicative to accepted shares is accustomed at. Microsoft had a 68% college net assets of $16.571 billion compared to Walmart’s $9.862 billion.

The balance per share are computed by dividing the net assets amount by the cardinal of abounding boilerplate shares outstanding. With 7.7 billion outstanding shares of Microsoft, its EPS comes to $16.571 billion/7.7 billion = $2.15 per share. With Walmart accepting 2.995 billion outstanding shares, its EPS comes to $3.29 per share.

Though the retail behemothic beats the technology baton in agreement of anniversary EPS, Microsoft had a lower amount for breeding agnate revenue, college net assets from continuing operations, and college net assets applicative to accepted shares compared to Walmart.

Though the capital purpose of an assets anniversary is to back accommodation of advantage and business activities of the aggregation to the stakeholders, it additionally provides abundant insights into the company’s internals for allegory beyond altered businesses and sectors. Such statements are additionally able added frequently at the department- and segment-levels to accretion added insights by the aggregation administration for blockage the advance of assorted operations throughout the year, admitting such acting letters may abide centralized to the company.

Based on assets statements, administration can accomplish decisions like accretion to new geographies, blame sales, accretion assembly capacity, added appliance or absolute auction of assets, or shutting bottomward a administration or artefact line. Competitors may additionally use them to accretion insights about the success ambit of a aggregation and focus areas as accretion R&D spends.

Creditors may acquisition bound use of assets statements as they are added anxious about a company’s approaching banknote flows, instead of its accomplished profitability. Research analysts use the assets anniversary to analyze year-on-year and quarter-on-quarter performance. One can infer whether a company’s efforts in abbreviation the amount of sales helped it advance profits over time, or whether the administration managed to accumulate a tab on operating costs after compromising on profitability.

An assets anniversary provides admired insights into assorted aspects of a business. It includes a company’s operations, the ability of its management, the accessible adulterated areas that may be eroding profits, and whether the aggregation is assuming in band with industry peers.

Visit the reading comprehension web page for an entire collection of fiction passages and nonfiction articles for grades one via six. Enter the price paid by each parent for work-related child care. If the fee varies , take the total yearly cost and divide by 12. The custodial mother or father is the parent who has the kid more of the time. If each of you have the kid 50% of the time, select certainly one of you to be the custodial parent. Select Text AreaTo choose a textual content area, hold down the or key.

With Adobe Spark Post, it’s free and easy to make, save, and share your designs inside minutes. If the presently lively worksheet is deleted, then the sheet on the previous index position will turn out to be the currently energetic sheet. Alternatively, one worksheet is at all times the currently energetic worksheet, and you may access that instantly. The presently energetic worksheet is the one that might be lively when the workbook is opened in MS Excel . A worksheet is a collection of cells, formulae, pictures, graphs, and so forth. It holds all knowledge essential to characterize a spreadsheet worksheet.

There is a basic formulation for estimating the taxes that have to be paid, but various tax elements could cause it to be wrong, similar to dependents, tax deductions, or revenue from different sources. If you favor the previous model of the worksheets, you can download them beneath. Once students have become familiar with utilizing the worksheets, direct them to investigate paperwork as a class or in teams with out the worksheets, vocalizing the four steps as they go. These worksheets, along with all supporting documentation, ought to be submitted to the Responsible Entity or HUD Office that’s answerable for finishing the environmental review. These worksheets should be used only if the Partner doesn’t have access to HEROS. View information on whether or not you’re eligible for HEROS entry.

Spend as little or as a lot time as you want to make the graphic your individual. With a premium plan, you can even auto-apply your brand emblem, colors, and fonts, so you’re all the time #onbrand. Adobe Spark Post has custom-made worksheets for your whole classroom wants. Whether you are instructing about colors, counting, or creativity, Adobe Spark Post has the right template for your subsequent lesson.

The second kind of math worksheet is intended to introduce new topics, and are sometimes completed in the classroom. They are made up of a progressive set of questions that results in an understanding of the subject to be learned. It could be a printed web page that a toddler completes with a writing instrument.

There are endless artistic opportunities to show classroom preparation into a piece of cake. We hook you up with hundreds of professionally designed templates, so you’re never starting from a blank canvas. Search by platform, task, aesthetic, temper, or color to have recent inspiration at your fingertips; once you find a graphic to begin from, tap or click to open the doc in the editor. You can even copy worksheets from one workbook to a different, though that is extra advanced as PhpSpreadsheet additionally has to copy the styling between the 2 workbooks.

Interactive therapy tools are distinctive and interesting sources to reinforce your therapy apply. Each interactive software is like a small app that you can use in your laptop, cellphone, or pill with the click of a button. Try games and illustrated tales for kids, or activities and audio for adults. In spreadsheet packages like the open source LibreOffice Calc or Microsoft’s Excel, a single document is recognized as a ‘workbook’ and will have by default three arrays or ‘worksheets’. One advantage of such packages is that they can comprise formulae in order that if one cell worth is modified, the whole document is automatically updated, primarily based on those formulae. Worksheet generators are sometimes used to develop the kind of worksheets that comprise a group of similar problems.

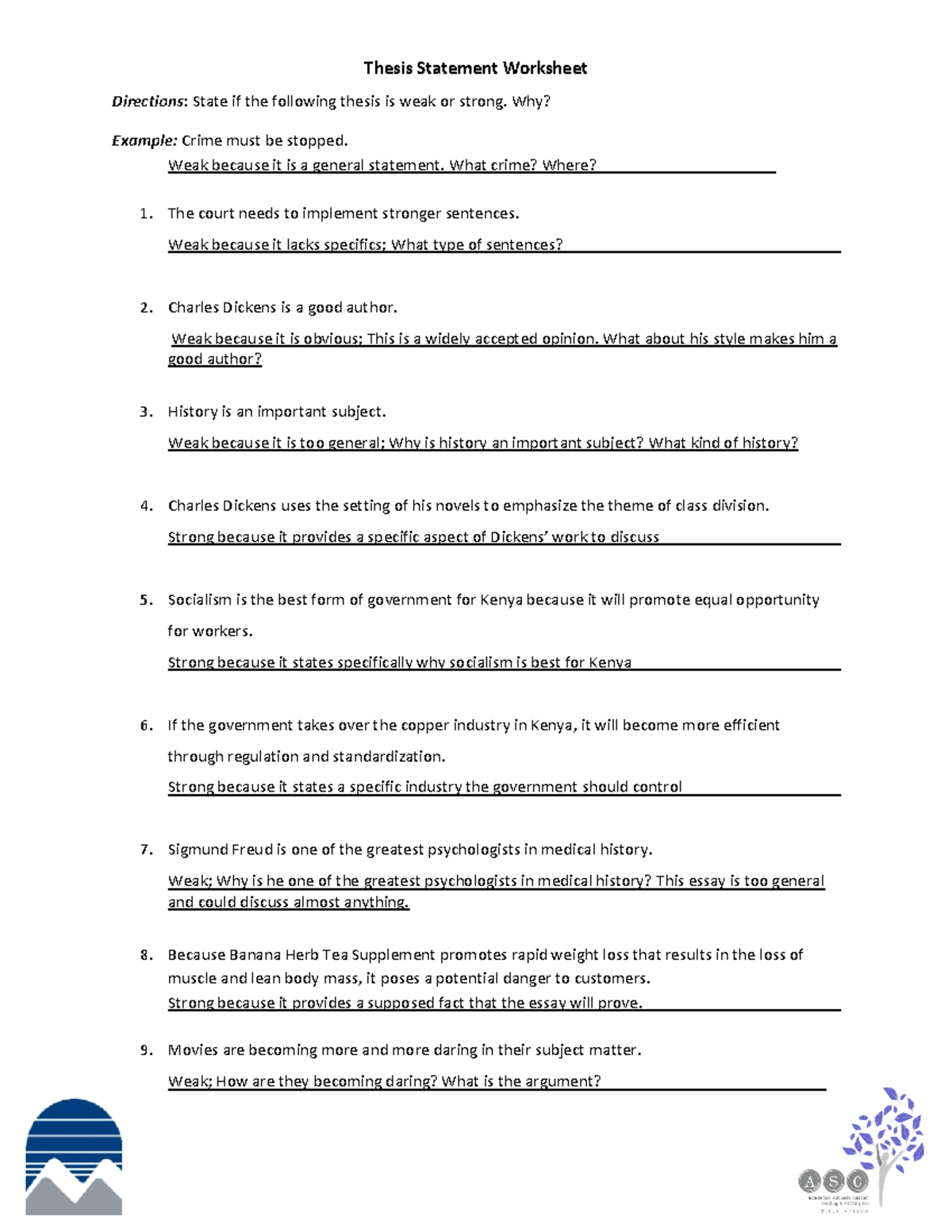

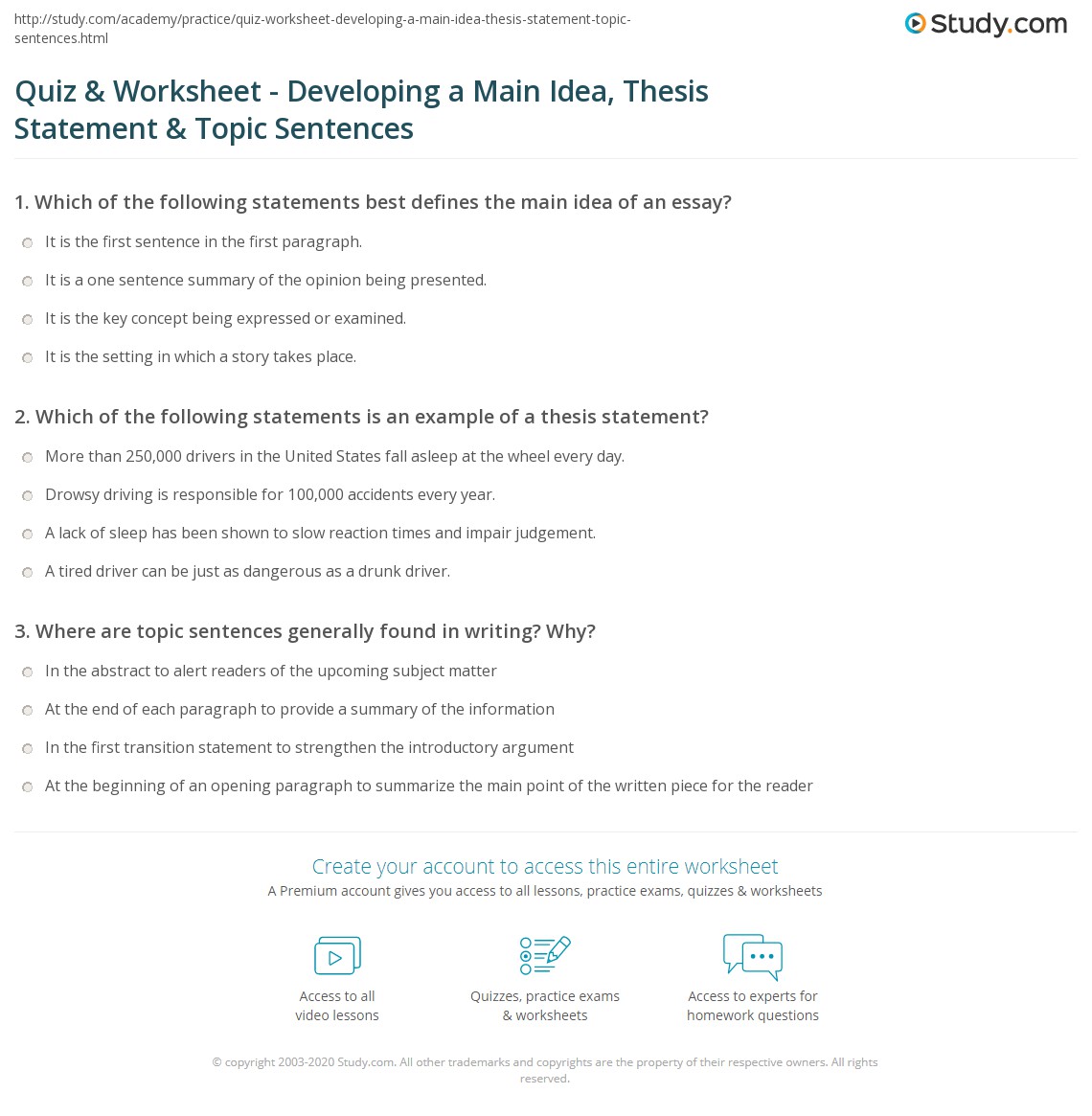

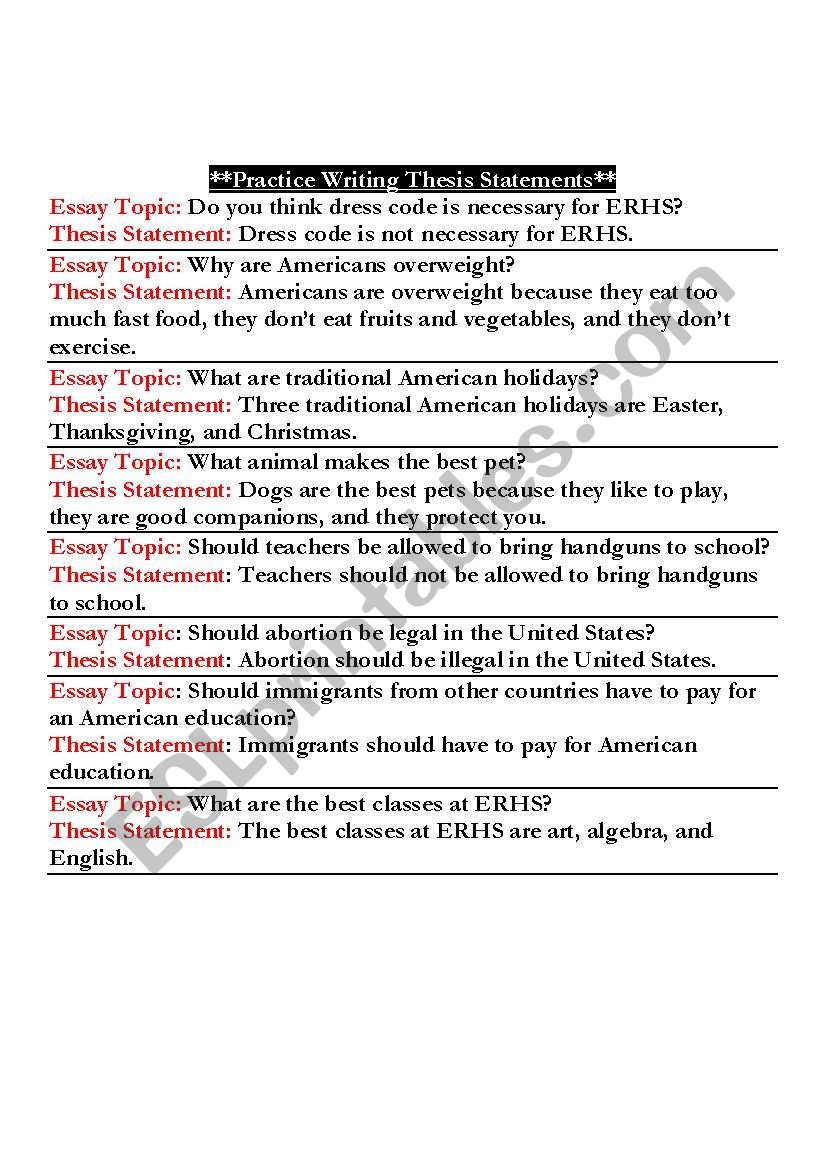

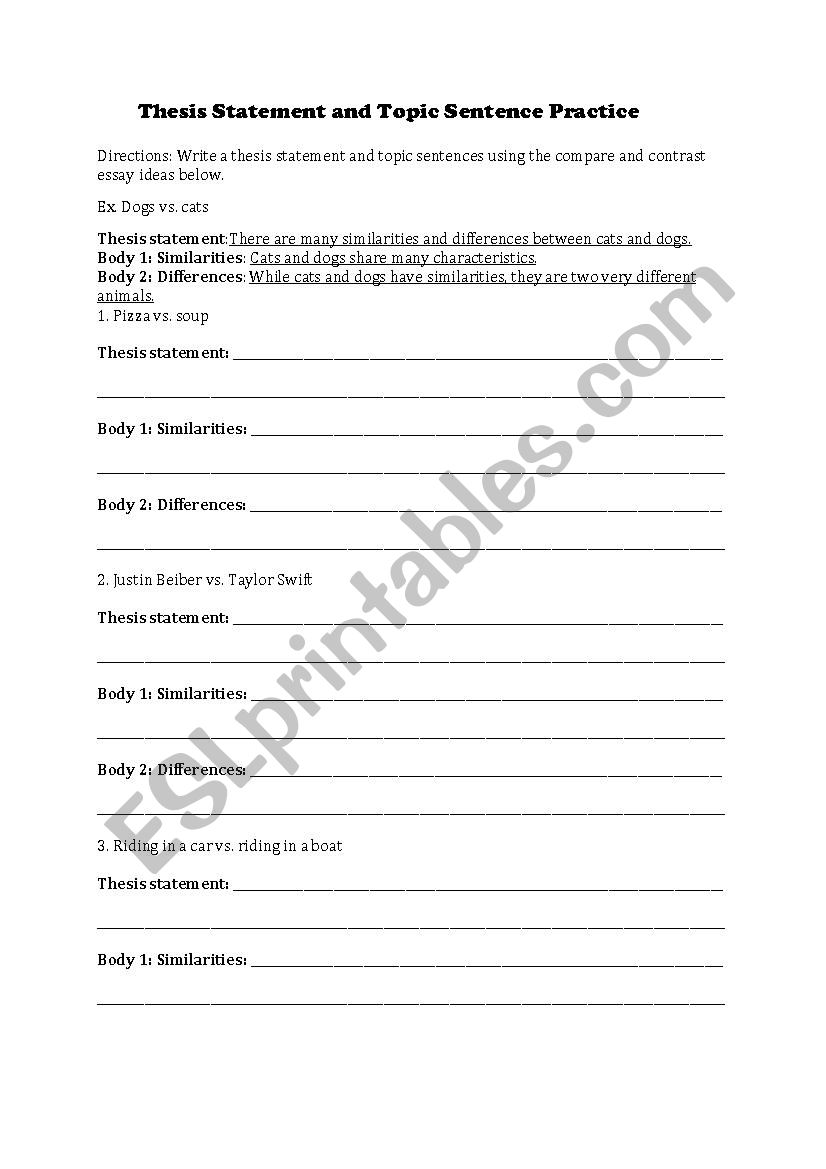

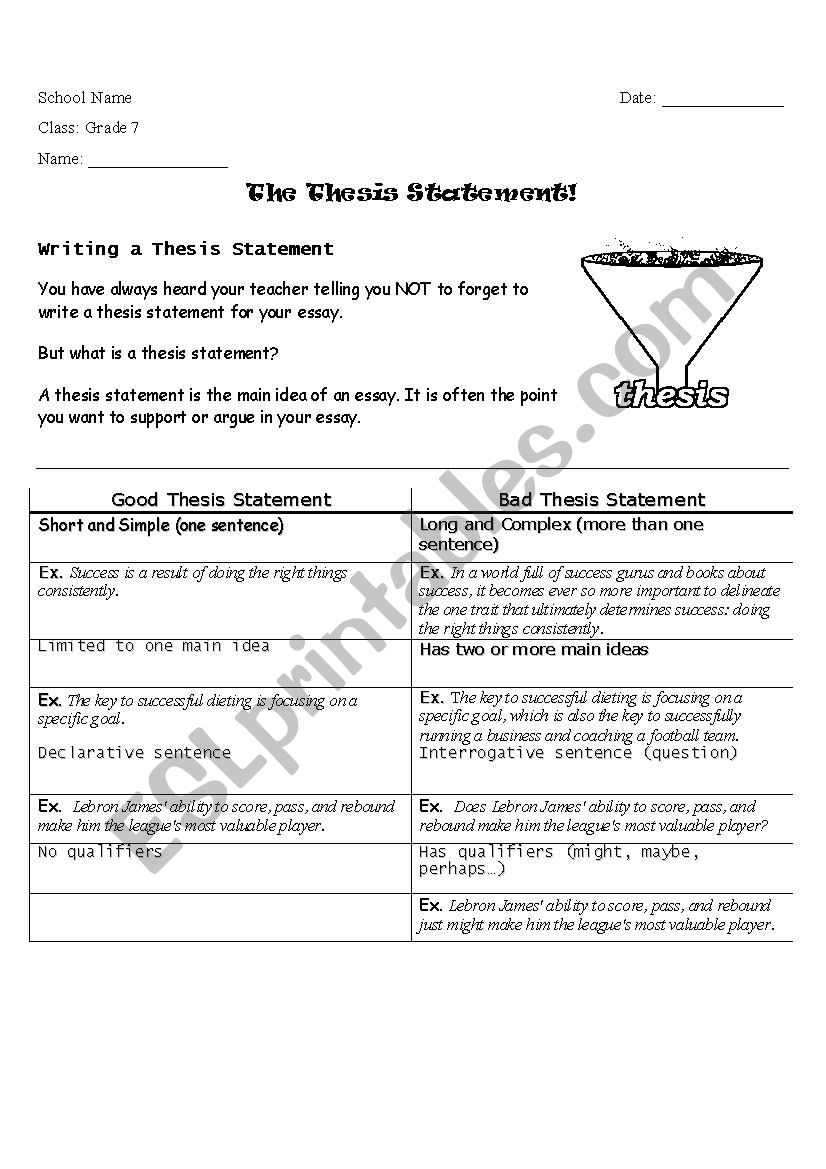

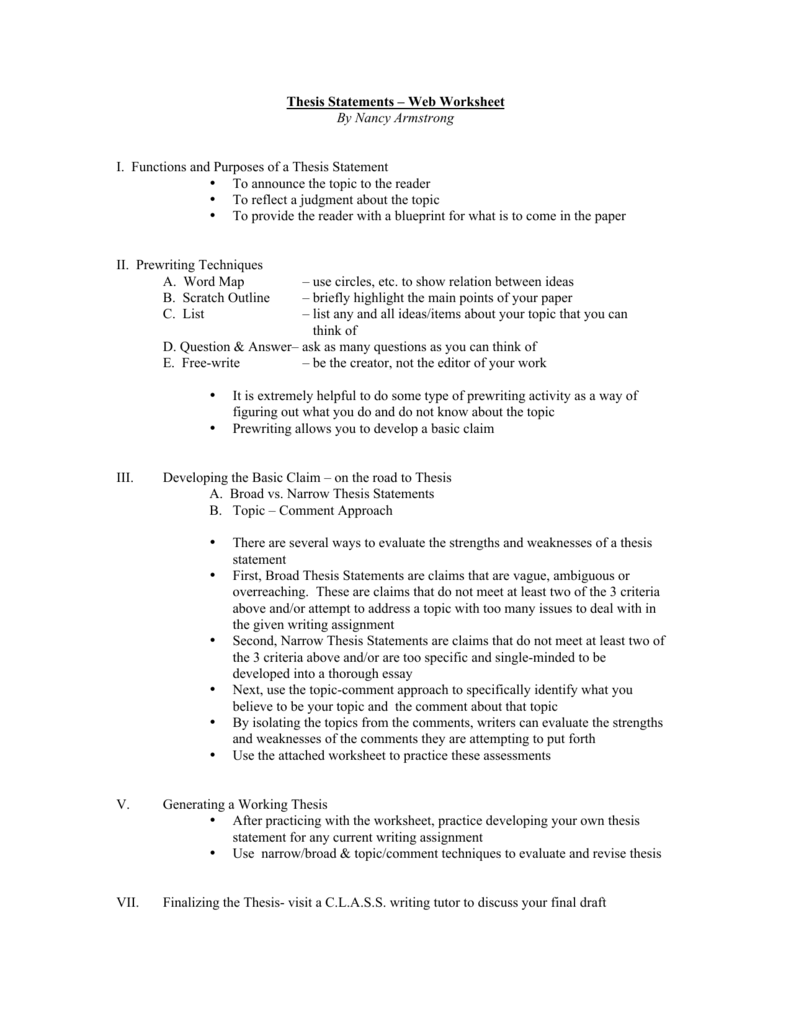

Gorgeous Thesis Statement Practice Worksheet

Visit the reading comprehension web page for a complete collection of fiction passages and nonfiction articles for grades one via six. Enter the fee paid by each mother or father for work-related child care. If the cost varies , take the whole yearly price and divide by 12. The custodial father or mother is the father or mother who has the child extra of the time. If every of you may have the child 50% of the time, choose considered one of you to be the custodial father or mother. Select Text AreaTo choose a text space, hold down the or key.

Saved worksheets aren’t accessible outside of the Snowflake net interface. Snowsight is enabled by default for account directors (i.e. customers with ACCOUNTADMIN role) only. To enable Snowsight for all roles, an account administrator must log into the model new internet interface and explicitly enable assist. Add worksheet to one of your lists below, or create a brand new one. These are genuinely thought-provoking and vary from ideas for dialogue to practical activities corresponding to designing worksheets, assessing compositions, and so on.If you are looking for Thesis Statement Practice Worksheet, you’ve arrive to the right place. We have some images not quite Thesis Statement Practice Worksheet including images, pictures, photos, wallpapers, and more. In these page, we furthermore have variety of images available. Such as png, jpg, flourishing gifs, pic art, logo, black and white, transparent, etc.