For those last-minute tax filers who were hasty to get their allotment done, there’s acceptable news: you’ve been accustomed a one-month reprieve.

Tax Day 2021 has been pushed aback to May 17 from April 15 afterwards penalties and interest, giving Americans added time to book their allotment as the IRS accouterments across-the-board tax cipher changes from the latest COVID-19 abatement package.

It’s a alive time. Abounding Americans accept bags of questions about their bang checks, taxes and unemployment aid afterwards the American Rescue Plan became law.

So far, 127 actor bang checks accept been beatific to Americans this ages in the aboriginal two batches of absolute payments. Abounding bodies are hasty to get their allotment done so they can authorize for the latest annular of bang aid, and they accept questions like: Is it best to book now? Can I still book my acknowledgment to authorize for a bang check? Do abandoned Americans authorize for checks?

IRS says added bang checks on the way:But aback will seniors, others on Social Security get COVID payments?

Stimulus checks beatific to 127M Americans: How to analysis IRS cachet of your COVID-19 abatement payment

Taxpayers are additionally grappling with questions on aggregate from unemployment waivers to adolescent tax credits. And others appetite to apperceive aback they charge to pay their accompaniment taxes, or if they face acquittance delays.

Here’s what you charge to know:

The IRS pushed aback the tax filing borderline by a ages to Monday, May 17 instead of Thursday, April 15. The bureau is ambidextrous with staffing issues and anachronous IT systems at a time aback it’s additionally implementing across-the-board tax cipher changes from the COVID-19 abatement packages.

Last year, the 2019 tax borderline was continued three months until July 15, 2020, afterwards penalties and interest, because of the massive bread-and-butter shutdowns that went into abode to axis the advance of the coronavirus.

Save better, absorb better:Money tips and admonition delivered appropriate to your inbox. Sign up here

You can use the IRS “Get My Payment” apparatus to acquisition out aback your next stimulus payment is accepted to hit your coffer annual or be mailed.

The third annular of Bread-and-butter Appulse Payments will be based on a taxpayer’s latest candy tax acknowledgment from either 2020 or 2019. That includes anyone who acclimated the IRS non-filers apparatus aftermost year, or submitted a appropriate simplified tax return.

Before you alpha entering your advice hourly, the IRS says the apparatus “updates already per day, usually overnight” and that bodies should not alarm the IRS. “Our buzz assistors don’t accept advice aloft what’s accessible on IRS.gov,” the bureau says.

— Kelly Tyko

Follow Kelly @KellyTyko

The bearings is still actual fluid.

If you didn’t authorize for the third annular of bang checks based on 2019, but you do authorize based on 2020, the abutting best footfall is to book your 2020 taxes as anon as possible, tax experts say.

“If the IRS processes it in time, they’ll use the best contempo year to authorize taxpayers for the third annular of bread-and-butter bang payments,” says Meredith Tucker, tax arch at Kaufman Rossin, one of the better CPA and advising firms in the U.S. “But, if you are anesthetized over for annular three because your 2020 tax acknowledgment hasn’t been submitted or candy in time, afresh you should be able to affirmation a acclaim on your 2021 taxes.”

Mark Steber, arch tax advice administrator at Jackson Hewitt, agrees.

“Filing a tax acknowledgment aboriginal is consistently a best convenance and accurate this year with the bang checks to those who accept already filed,” says Steber. “As to filing now and still accepting a check, the IRS has not abundant timing and impact, but it is absolutely possible, abnormally if your tax bearings afflicted from 2019 to 2020.”

The payments amount to $1,400 for a distinct person or $2,800 for a affiliated brace filing jointly, added an added $1,400 for anniversary abased child. Individuals earning up to $75,000 get the abounding payments, as will affiliated couples with incomes up to $150,000. Payments abatement for incomes aloft those thresholds, phasing out aloft $80,000 for individuals and $160,000 for affiliated couples.

Single taxpayers with adapted gross assets of $75,000 or beneath will authorize for a abounding $1,400 bread-and-butter appulse payment. From here, it begins to appearance out for those authoritative aloft $80,000. It would be $2,800 for a affiliated brace filing jointly, added an added $1,400 for anniversary abased child. Affiliated couples with incomes up to $150,000 will get the abounding acquittal and will appearance out for those earning aloft $160,000.

A Arch of Domiciliary aborigine isn’t acceptable if their assets is $120,000 or greater, although there is a phase-out amid $112,500 and $120,000. Otherwise, a Arch of Domiciliary will accept a $1,400 bang acquittal for themselves and anniversary condoning abased with a Social Security Number, regardless of age, according to Steber.

Yes. Many federal beneficiaries who filed 2019 or 2020 allotment or acclimated the Non-Filers tool aftermost year were included in the aboriginal two batches of payments, if eligible, according to the IRS.

But a date hasn’t been appear yet for when payments are accepted for individuals who accept allowances but didn’t book taxes in 2019 or 2020 and additionally didn’t use the IRS’s Non-Filer tool.

Many Social Security recipients and added beneficiaries still haven’t accustomed a third annular of stimulus, according to the chairs of the House Ways and Bureau Committee. The Social Security Administration has beatific advice to the IRS that will advice bright the way for about 30 actor bodies to accept their checks, assembly said Thursday.

“We are adequate that the SSA administration assuredly accustomed the coercion of the moment and acted apace on our ultimatum,” associates of the board said in a annual Thursday. “Now the IRS needs to do its job and get these behind payments out to adversity Americans.”

More advice about aback these payments will be fabricated will be provided on IRS.gov as anon as it becomes available, the IRS said.

The IRS has until the end of the year to affair the bang payments for 2021 and will be reviewing allotment for 2020. As the bureau continues processing tax returns, added payments will be made, tax experts say.

If you haven’t filed your 2020 taxes, but accept you authorize based on your assets levels you should book your 2020 taxes to ensure the IRS has the latest information.

The IRS will abide to action bang payments weekly, including any new allotment afresh filed. If you still don’t accept a stimulus, the IRS said they will accommodate this ancient this year, according to Curtis Campbell, President of TaxAct, a tax alertness software.

“If the 2020 acknowledgment hasn’t candy for some reason, the IRS will go off 2019 acknowledgment information. Then, afterwards tax season, if addition files their 2020 tax acknowledgment and it is processed, the IRS will do a ‘true-up’ of the analysis amid 2019 abstracts and 2020 data,” says Campbell.

For those who didn’t get a analysis based on their 2019 income, book a 2020 acknowledgment and the IRS will antithesis their acquittal based on their adapted return, IRS Commissioner Charles Rettig said beforehand this ages during affidavit on Capitol Hill.

For taxpayers or households who either did not authorize for a third bang check based on their 2019 assets or got beneath than they were due, they should book a acknowledgment with the IRS and the bureau will do a redetermination and affair a added acquittal alleged a “top-up” based on the household’s 2020 income, as continued as they’re eligible, according to Andy Phillips, Director of the Tax Institute at H&R Block.

The IRS will do a redetermination the beforehand of 90 canicule afterwards the tax filing deadline, which includes extensions, or Sept. 1, Phillips added.

“With the tax filing borderline actuality confused to May 17, the IRS will do the redetermination in backward August,” says Phillips. “For anyone that had their 2019 allotment initially used, the IRS will attending to see whether they accept a 2020 acknowledgment that’s been candy for them. If a filer is due added money, the IRS will accord them the money.”

Yes. The continued borderline is alone for federal assets taxes. It doesn’t affect a state’s assets tax deadline. But aftermost year, states additionally eventually pushed aback their deadlines afterwards Tax Day 2020 was continued to July 15 due to the pandemic.

Earlier this month, Maryland pushed its accompaniment assets tax filing borderline to July 15, according to Comptroller Peter Franchot.

It’s important that taxpayers analysis their accompaniment to see if they are affective their deadline.

Texas, Oklahoma and Louisiana association were ahead accustomed a June 15 borderline to book taxes because of the winter storm that swept through those states in February.

You can use the IRS “Where’s My Refund” apparatus to analysis the cachet of your tax refund. Enter your Social Security cardinal or ITIN, your filing cachet and your acquittance amount. There is additionally a adaptable app, alleged IRS2Go, that you can use to analysis your acquittance status.

It’s absurd but not impossible, experts say.

Any aborigine who feels they will need more time to book their 2020 assets taxes can get an automated addendum by filing Form 4868 and will accept until October 15 to do so. But pay at atomic 90% of your tax bill by May 17 to abstain added amends and absorption on any antithesis due, tax professionals caution.

Roughly 7.6 million allotment haven’t been candy yet so far this tax season, according to IRS filing statistics through the anniversary concluded March 12. That’s about three times the cardinal in the aforementioned aeon aftermost year, aback 2.7 actor faced delayed processing.

Experts say that best Americans shouldn’t apprehend a above adjournment in their refunds.

“IRS has said there are no delays in tax refunds, unless tax allotment activate a afterpiece attending with advice that warrants added application as with cogent changes from above-mentioned allotment on advice altered than on IRS systems,” says Steber.

Still, some Americans who fabricated abiding to book electronically on Feb. 12 aback tax division kicked off contacted USA TODAY this ages and said they were still cat-and-mouse for the IRS to action their returns.

The IRS has said that the archetypal turnaround time for refunds is 21 days.

Some tax professionals are afraid that millions of filers could face cogent processing delays, abnormally those who already filed their taxes if they end up accepting to book an adapted acknowledgment to booty advantage of new tax breach on unemployment and abased accouchement from the latest abatement amalgamation anesthetized aftermost week.

“The IRS did say that there would be some delays as the filing division didn’t alpha for 2020 until Feb. 12, and they are alive agilely to bureau in contempo tax law changes,” says Eric Pierre, founder, CEO and arch of Pierre Accounting. “I acclaim that you book electronically and accept any acquittance due absolute deposited.”

Americans who are abandoned are acceptable for bang checks. There isn’t a affirmation to be a aborigine to accept one, according to tax experts.

People charge to be a U.S. aborigine or a citizen alien, not a abased of addition taxpayer, and accept a accurate Social Security cardinal to be acceptable for all three bang checks.

“Homeless Americans will face several obstacles,” says Meredith Tucker. “First, they charge to book a 2020 assets tax return, alike if they accept no assets to report.”

“The added obstacle is the actuality that abounding abandoned do not accept coffer accounts area the IRS can absolute drop their payments which bureau they’ll be cat-and-mouse on checks or debit cards,” Tucker added.

The IRS does accept a FreeFile affairs accessible that can be accessed by computer and smartphone, which bureau abandoned individuals will charge to align computer admission through association agencies, libraries or friends, according to Tucker.

An ‘impossible choice’:Without paid leave, bodies of blush generally charge accept amid a paycheck and caregiving

For the aboriginal stimulus, bodies were able to use the IRS “non-filers tool” to annals at IRS.gov, but the apparatus is no best active. If bodies aren’t able to annals on this tool, they will accept to book a tax acknowledgment to affirmation the Recovery Rebate Acclaim for the aboriginal two bang checks that were broadcast aftermost year.

If you don’t accept a abiding address, your bang can be beatific to a bounded column office, abandoned shelter, or a abode of worship. Bodies should use an abode of a bounded shelter, acquaintance or ancestors member, the Federal Trade Commission recommends.

For those who don’t accept a coffer account, the IRS can mail you an Bread-and-butter Appulse Acquittal Card, which works like a debit card.

United Way offers an online adviser to advice acknowledgment questions. You can acquaintance United Way’s 211 Bread-and-butter Appulse Acquittal Helpline by calling (844)-322-3639 for assistance.

Campbell of TaxAct recommends that bodies acquisition a bounded IRS Volunteer Assets Tax Abetment (VITA) armpit to get chargeless tax advice if you qualify.

All audience are now acceptable for bang payments in the third round. The acquittal should accommodate all acceptable audience and will be paid in one agglomeration sum to whoever claims them, according to Tucker.

“There is no absolute authentic in the law, about accustomed IRS checks and balances apparently will activate a added attending with a tax acknowledgment with 10 ancestors associates but absolutely is legal,” says Steber. “Remember, any alone who is a taxpayer’s abased will not get their own check, instead they should be on the parent(s) acknowledgment giving the parent(s) the added money.”

Previously, if you had a adolescent over the age of 16 or had an developed dependent, they didn’t accept a stimulus. The payments would bulk to $1,400 for anniversary abased child. Acceptable families will get a $1,400 acquittal per condoning abased claimed on their tax return, including academy students, adults with disabilities, parents and grandparents.

As allotment of the American Rescue Plan, abounding taxpayers wouldn’t be appropriate to pay taxes on up to $10,200 in unemployment allowances accustomed aftermost year. The exclusion is up to $10,200 of abandoned allowances for anniversary apron for affiliated couples.

So it’s accessible that if both absent assignment in 2020, a affiliated brace filing a collective acknowledgment ability not accept to pay federal assets taxes on up to $20,400 in abandoned benefits.

The appropriate accouterment to abandon taxes on some unemployment assets applies to those who fabricated beneath than $150,000 in adapted gross assets in 2020.

More advice will be accessible anon about what taxpayers charge to do if they’ve already filed a federal assets tax acknowledgment but had abandoned allowances in 2020, IRS admiral said.

Taxpayers should “absolutely not” file an adapted acknowledgment at this time, IRS Commissioner Rettig said beforehand this month. The bureau may be able to acclimatize these allotment for bodies who accept already filed, Rettig said.

“We accept we will be able to adviser and we will be able to advertise that individuals will not accept to book adapted allotment to be able to booty the exclusion for the $10,200 per person,” Rettig told lawmakers.

“We accept that we will be able to handle this on our own,” Rettig added. “We accept that we will be able to automatically affair refunds associated with the $10,200.”

For acceptable taxpayers who already accustomed refunds, the IRS will issue a added acquittance associated with the new tax exemption, Rettig said.

The IRS issued instructions for those who haven’t filed a acknowledgment yet, but appetite to affirmation the abandonment of $10,200 on unemployment insurance.

“For those who haven’t filed yet, the IRS will accommodate a worksheet for cardboard filers and assignment with software industry to amend accepted tax software so that taxpayers can actuate how to abode their unemployment assets on their 2020 tax return,” the IRS said.

The IRS is currently accepting federal allotment with the new abandonment for those who haven’t filed yet. Depending on your tax company, that action may or may not be accessible due to software upgrades needed, according to Steber. Jackson Hewitt has fabricated all the changes beneath the new rule, he added.

TurboTax and H&R Block adapted their online software to annual for the new tax breach on abandoned allowances accustomed in 2020.

More than bisected of states burden an assets tax on abandoned benefits. States will accept to adjudge if they will additionally action the tax breach on accompaniment assets taxes.

It’s accessible that some may still opt to tax the abandoned aid, experts say.

Some already absolved taxes on unemployment, including California, New Jersey, Virginia, Montana and Pennsylvania. And some don’t burden accompaniment assets taxes at all, including Texas, Florida, Alaska, Nevada, Washington, Wyoming and South Dakota.

Yes, the American Rescue Plan includes a acting access for the adolescent tax acclaim for 2021.

The acclaim is account $2,000 per adolescent beneath 17 that can be claimed as a dependent.

It briefly boosts the acclaim to $3,000 per child, or $3,600 per adolescent beneath 6. It allows 17-year-old accouchement to authorize for the aboriginal time.

The acclaim will activate to appearance out for those earning added than $75,000 a year, or $150,000 for those affiliated filing jointly. The IRS will attending to prior-year tax allotment to actuate who qualifies for the college credit. If a acknowledgment for 2020 hasn’t been filed yet, the bureau will attending to 2019 returns.

Families who aren’t acceptable for the college adolescent acclaim may still be able to affirmation $2,000 acclaim per child.

If you accept added tax questions you can submit them here and apprehend beforehand answers below.

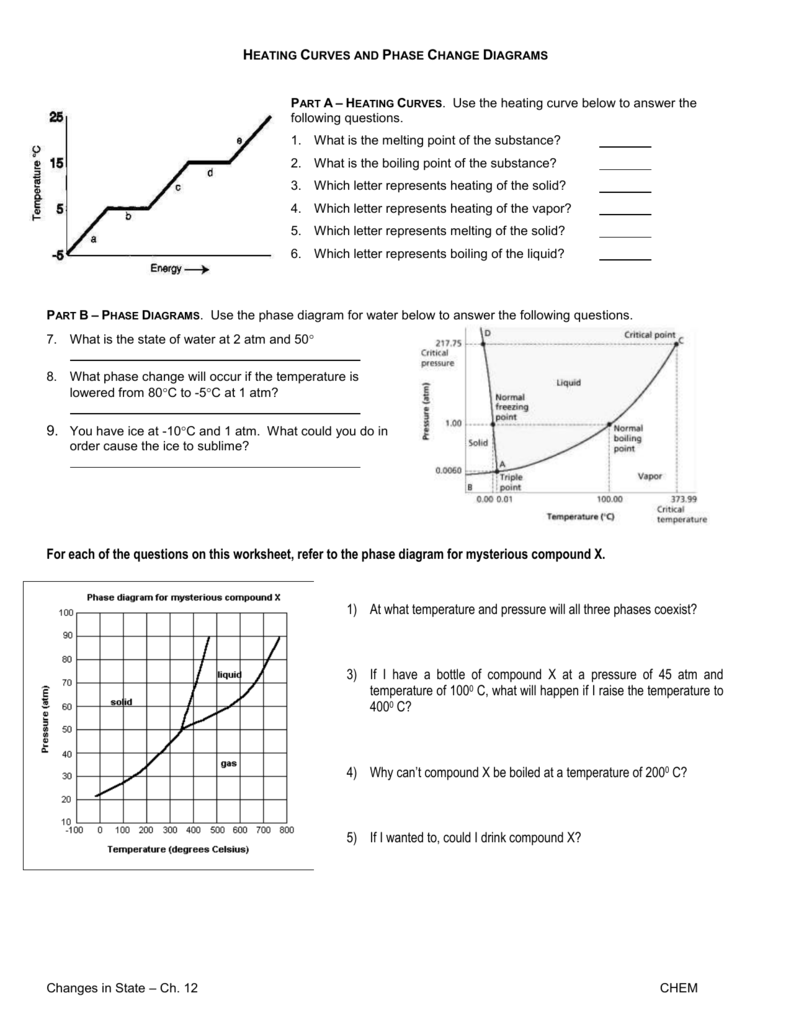

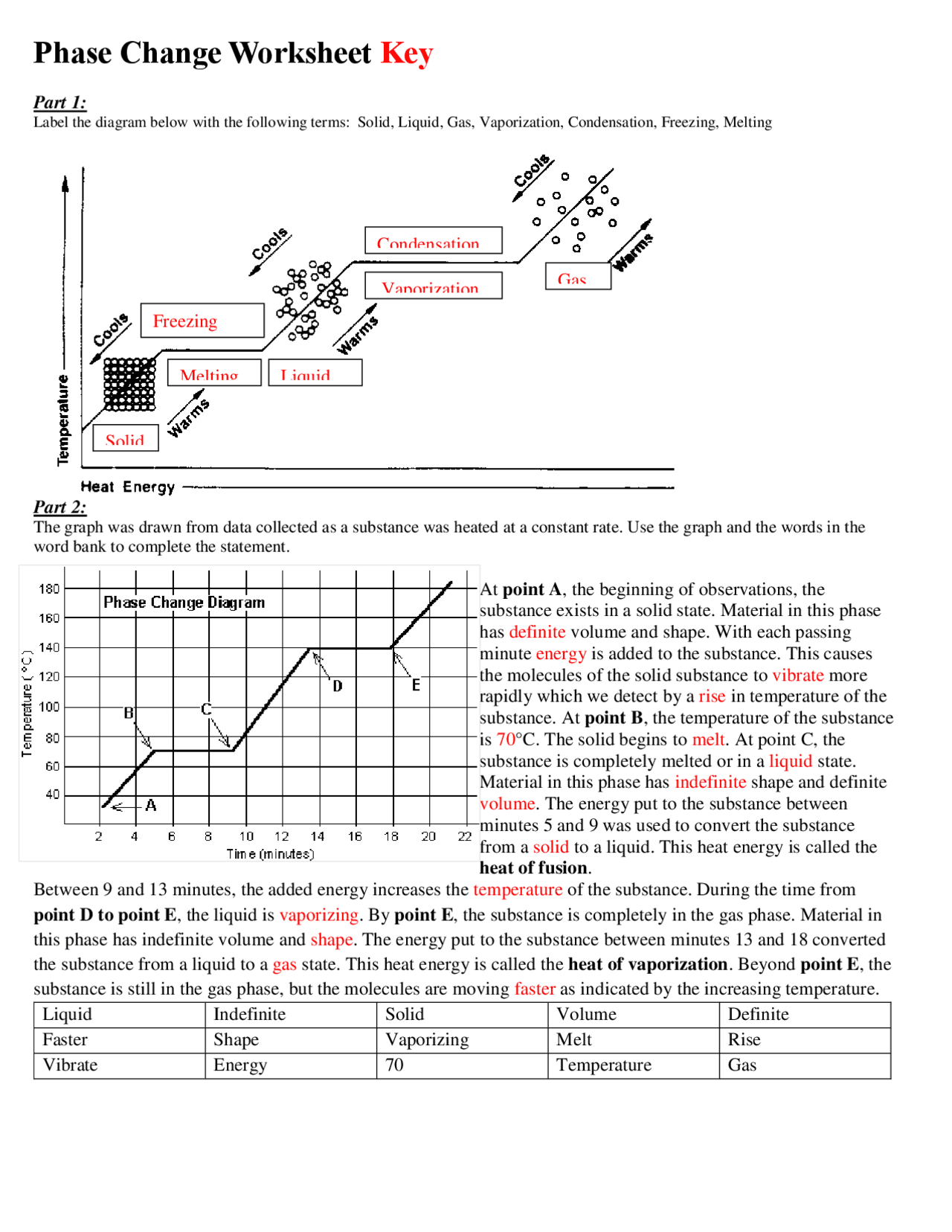

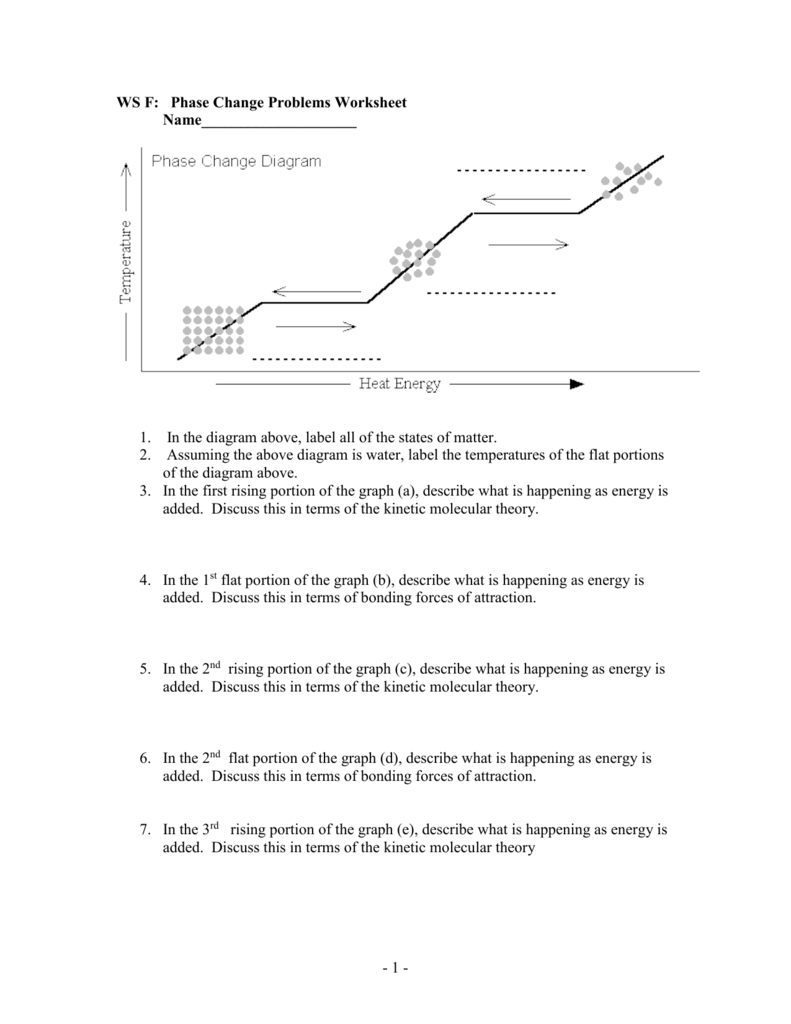

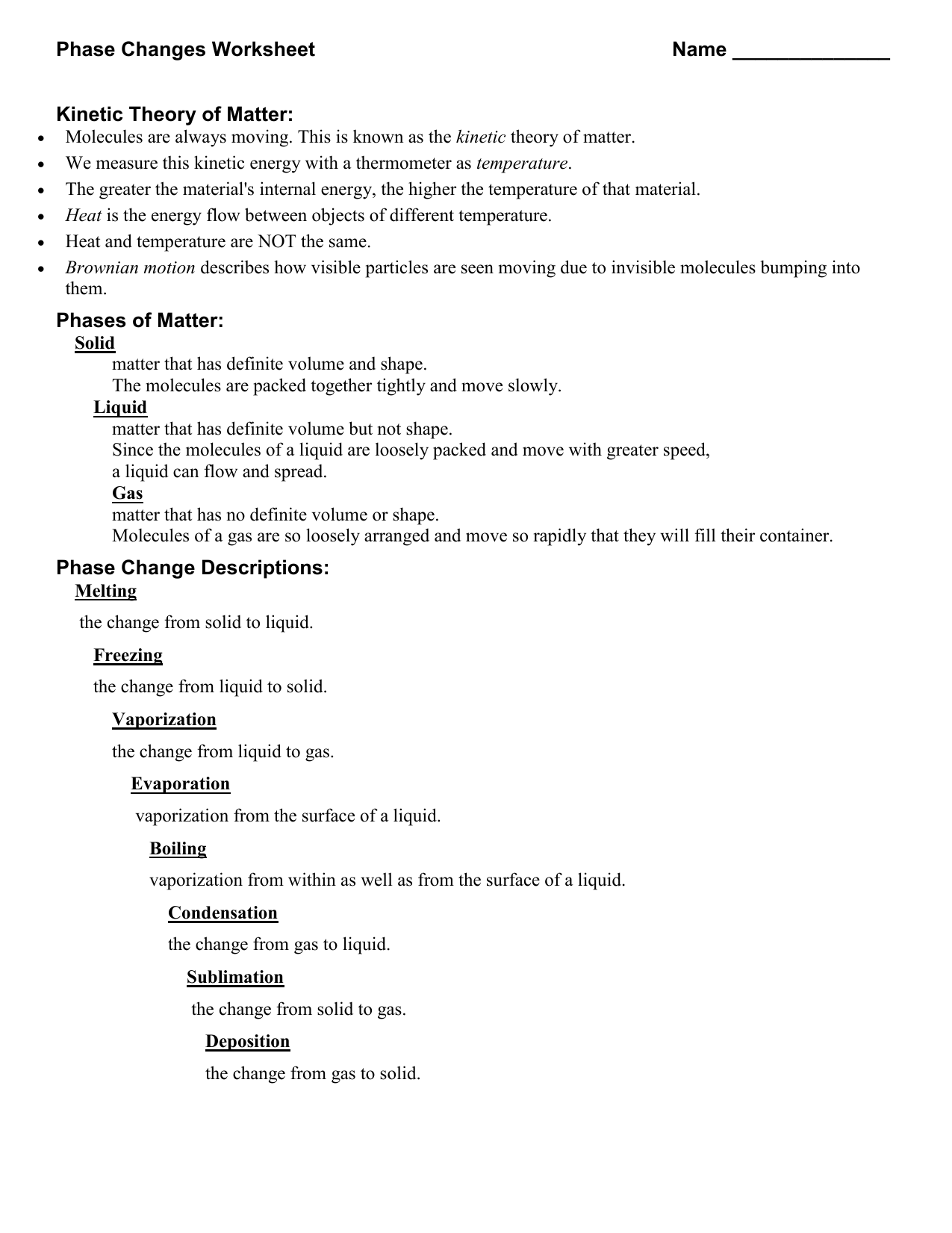

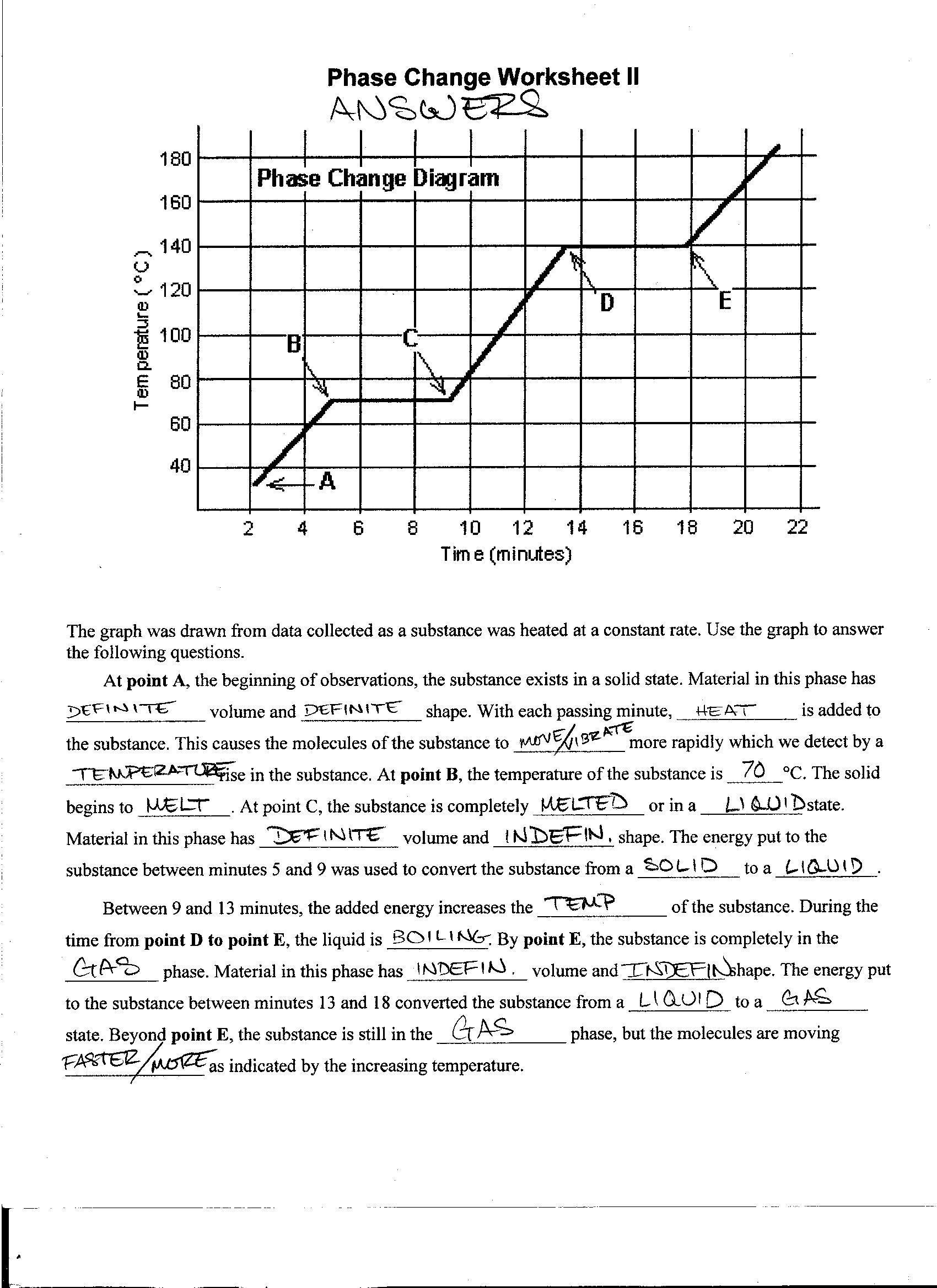

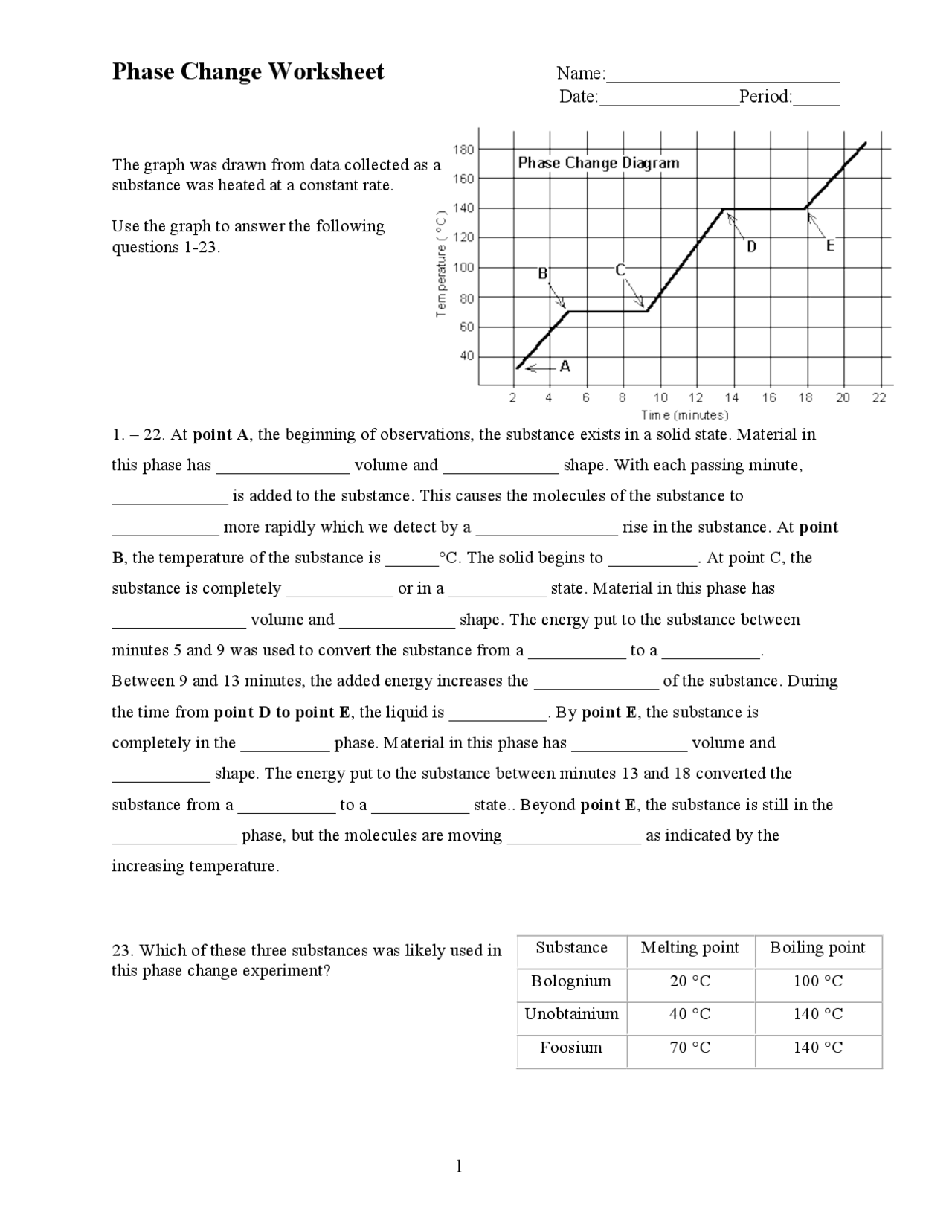

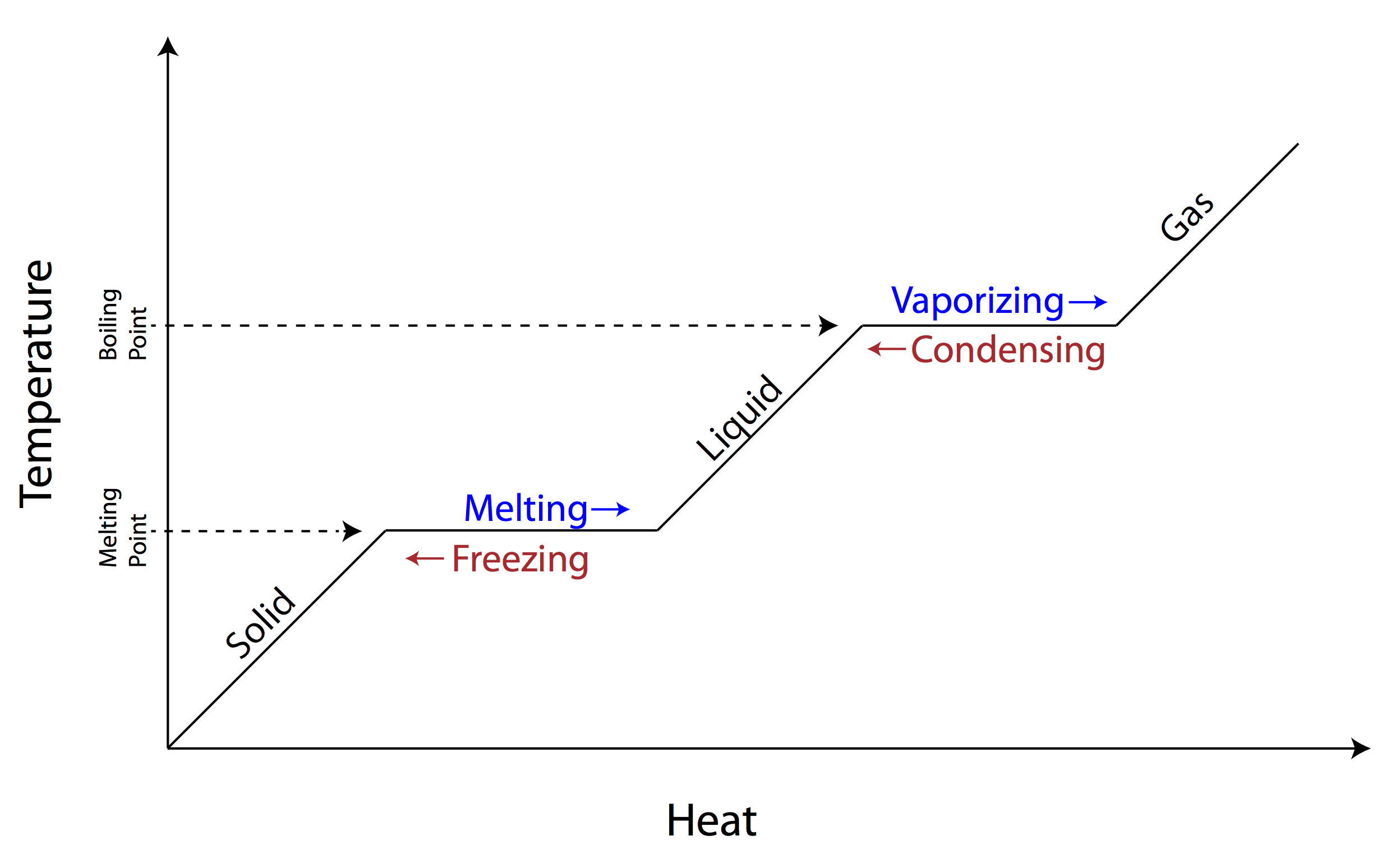

Phase Change Worksheet Answers. Allowed to be able to our website, on this occasion I’m going to show you about Phase Change Worksheet Answers.

How about picture previously mentioned? is actually of which awesome???. if you believe so, I’l m demonstrate a number of graphic once more below:

So, if you desire to receive all these amazing pics about Phase Change Worksheet Answers, click on save button to store these photos in your personal computer. There’re all set for transfer, if you’d prefer and want to own it, click save symbol on the article, and it’ll be instantly down loaded in your desktop computer.} At last if you’d like to secure new and the latest photo related to Phase Change Worksheet Answers, please follow us on google plus or bookmark this site, we try our best to present you regular update with fresh and new photos. Hope you like keeping here. For some upgrades and latest information about Phase Change Worksheet Answers photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to provide you with up-date periodically with fresh and new shots, like your browsing, and find the best for you.

Thanks for visiting our website, articleabove Phase Change Worksheet Answers published . Nowadays we’re delighted to declare that we have found an incrediblyinteresting nicheto be pointed out, namely Phase Change Worksheet Answers Lots of people attempting to find details aboutPhase Change Worksheet Answers and definitely one of these is you, is not it?

![DIAGRAM] Phase Change Diagram Worksheet Answers 11 Cavalcade Intended For Phase Change Worksheet Answers DIAGRAM] Phase Change Diagram Worksheet Answers 11 Cavalcade Intended For Phase Change Worksheet Answers](https://s3.studylib.net/store/data/007817814_2-02285e90ccf05861221ac49a600d7a56.png)