April 11, 2022 2:02 PM

Posted: April 11, 2022 2:02 PM

Updated: April 14, 2022 6:38 AM

If you haven’t filed your taxes yet, it’s time to adjudge whether or not to administer for an extension, and allotment of that appliance is ciphering tax due. The borderline to book your 2021 tax acknowledgment is April 18 but an addendum can beforehand that borderline out to October 17.

For taxpayers missing abstracts or ambidextrous with a complicated tax situation, this gives you added time to file, but accumulate in apperception that this doesn’t accord you added time to pay.

Uncle Sam still expects you to appraisal your tax bill and pay what you owe by April 18.

You can get an automated tax-filing addendum by appointment Anatomy 4868 application the IRS Chargeless Book tool, and Allotment II of the anatomy asks you to appraisal your tax bill for 2021.

While you’re not appropriate to pay this bulk to get the extension, the IRS recommends you do to abstain the 0.5% abortion to pay amends that’s answerable anniversary ages that the tax goes unpaid. However, the amends won’t beat 25% of your contributed taxes.

You can beacon bright of the boundless backward acquittal penalties by advantageous the bottom of 100% of the tax due from your 2020 acknowledgment (110% if your adapted gross assets (AGI) is over $150,000) or 90% of your estimated tax due for 2021 by April 18.

If you’re not abiding how abundant you owe, actuality are a few almost accessible means to appraisal your tax bill for 2021.

The easiest way to appraisal the tax you owe for 2021 is to abject it on aftermost year’s income, says Charles Corsello, an enrolled abettor and architect of TaxCure LLC. “If you becoming about the aforementioned bulk as aftermost year, you would owe about the aforementioned amount.”

Start by blockage your absolute tax due for 2020—you can acquisition this on band 24 of your 2020 tax return. Then decrease taxes you already paid in 2021 from this amount, which would accommodate money that your employer withheld from your paychecks. If you fabricated estimated tax payments because you’re self-employed, you can decrease those payments as well.

From there, decrease the tax credits you ability authorize for to added abate your tax liability. “It is important, though, to accumulate in apperception any avant-garde Adolescent Tax Acclaim payments you accustomed already,” says Corsello. Check Letter 6419 to see the bulk you accustomed and analyze this bulk to the acclaim bulk for which you’re eligible. (If you haven’t accustomed Letter 6419, or you confused it, you can additionally log into your IRS annual to analysis those payments.)

If your beforehand payments were beneath than the bulk of acclaim you’re advantaged to, you could affirmation an added credit. If the bulk you accustomed in beforehand exceeds the bulk of the Adolescent Tax Acclaim you authorize for, you may allegation to accord some or all of it.

Use our calculator to appraisal your absolute adolescent tax credit.

After you’ve taken your absolute tax due for 2020 and subtracted 2021 withholding, tax payments, acceptable credits and rebates, you should get a appropriate appraisal of what you owe for 2021, provided that annihilation above has afflicted in your banking situation.

Perhaps you got a accession or landed a job with a bigger bacon in 2021. You’ll aboriginal allegation to account your taxable assets to appraisal the taxes owed aback your antithesis changed. Do this by demography your gross assets and adding exemptions and deductions you authorize for.

Then advertence your tax bracket to actuate tax liability. For 2021, bordering ante are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Where you abatement depends on your assets and filing status. Once you’ve ample out your absolute tax due, you can subtract money withheld from your paycheck for 2021 and any tax credits you authorize for to appraisal your tax bill for the year.

If you get ashore with this calculation, you could assignment through the IRS’s 1040-ES 2021 Estimated Tax Worksheet. “It is long, but it provides admonition and a anatomy that you can use to accurately appraisal what you will owe,” says Corsello.

For self-employed workers that don’t accept tax withheld by an employer, the Self-Employment Tax and Deduction Worksheet allotment of 1040-ES can additionally advice you appraisal annual payments that allegation to be fabricated on April 15, June 15, September 15 and January 15, 2023.

Read more: Everything to Know About 2022 Tax Deadlines and Dates

Typing in your income, filing cachet and added advice into an online assets tax calculator or tax software is another—possibly beneath cumbersome—way to actuate your tax liability.

“Many tax software filing programs abandoned allegation you aback you book so you can get a ballpark cardinal advanced of time,” says Corsello.

If you’re cerebration about application a calculator or tax software, actuality are some abeyant pros and cons:

Pros:

Cons:

If you can’t pay taxes, don’t panic—but don’t avoid the bearings either. Not filing your tax acknowledgment at all comes with a abrupt tax amends that’s 5% of your contributed tax antithesis per month.

Instead of not filing, the IRS has acquittal options you could assurance up for to pay over time, or you could borrow money to pay what you owe.

Here are a few options to consider.

Getting on an IRS acquittal plan doesn’t annihilate penalties on contributed taxes—but it could abate the cost. If you get on an accustomed acquittal plan, the backward acquittal amends is bargain from 0.5% to 0.25% per month. Signing up for the concise plan is free, and it gives you 180 canicule to pay your tax bill.

Long-term claim affairs let you pay off what you owe in several account installments. The bureaucracy fee for a abiding plan is $31 if you assurance up for autopay but bumps up to $130 if you don’t assurance up to accomplish payments through absolute debit.

If you’re experiencing banking accident or you owe an bulk that would be difficult to pay due to your income, the IRS may be accommodating to achieve your tax bill for beneath than what you owe with what’s alleged an “offer in compromise.” The adjustment or accommodation bulk may be paid in a agglomeration sum or installments, and you can administer for a accommodation with Anatomy 656.

Since the IRS amends for not filing is high, it makes faculty to go advanced and book for an addendum if you doubtable you won’t accomplish the April deadline.

You additionally don’t accept to handle all of this alone, abnormally in a complicated tax scenario. A tax able could advice you cross your addendum and tax acknowledgment filing if you’re borderline what to pay and how best to pay it.

The assertion which is prepared for ascertaining revenue of business on the finish of an accounting interval is recognized as an income statement. The distinction between the totals of debit and credit columns is transferred to the stability sheet column of the worksheet. Debit and credit balances of ledger accounts are written within the debit and credit columns of the trial steadiness respectively.

However, authentic worksheets may be made on functions such as word or powerpoint. A worksheet, within the word’s original meaning, is a sheet of paper on which one performs work. [newline]They are available many varieties, most commonly related to kids’s faculty work assignments, tax types, and accounting or different business environments. Software is increasingly taking on the paper-based worksheet.

If you need to edit any of the values, click on File after which Make a duplicate possibility to save it to your Google Drive. Not to be confused with the file name, in Microsoft Excel, there’s a 31 character restrict for every worksheet name. Spreadsheets can maintain track of your favorite player stats or stats on the whole group. With the collected data, you can also discover averages, high scores, and statistical data. Spreadsheets can even be used to create tournament brackets.

In our example, we copied the November worksheet, so our new worksheet is identified as November . All content material from the November worksheet has additionally been copied to the model new worksheet. Right-click the worksheet you need to copy, then choose Move or Copy from the worksheet menu. Please refer to this spreadsheet to answer the following questions. These slides will take you thru some tasks for the lesson. If you need to re-play the video, click on the ‘Resume Video’ icon.

This option is helpful if you’ve discovered a mistake that you incessantly make. In the Find Format dialog field, Excel won’t use any formatting choice that’s clean or grayed out as part of it’s search standards. For example, right here, Excel won’t search primarily based on alignment. In some versions of Windows, it seems like the checkbox is crammed with a strong sq. (as with the “Merge cells” setting in this example). In different variations of Windows, it appears like the checkbox is dimmed and checked on the same time. Either method, this visual cue signifies that Excel won’t use the setting as part of its search.

For example, if a formulation that accommodates the cell reference “C4” is copied to the subsequent cell to the proper, the reference will change to D4 . If the identical method is copied down one cell, the reference will change to “C5” . The other type of reference is an Absolute Reference. Freezing is a way that can be utilized in larger spreadsheets to assist in viewing the data on the display.

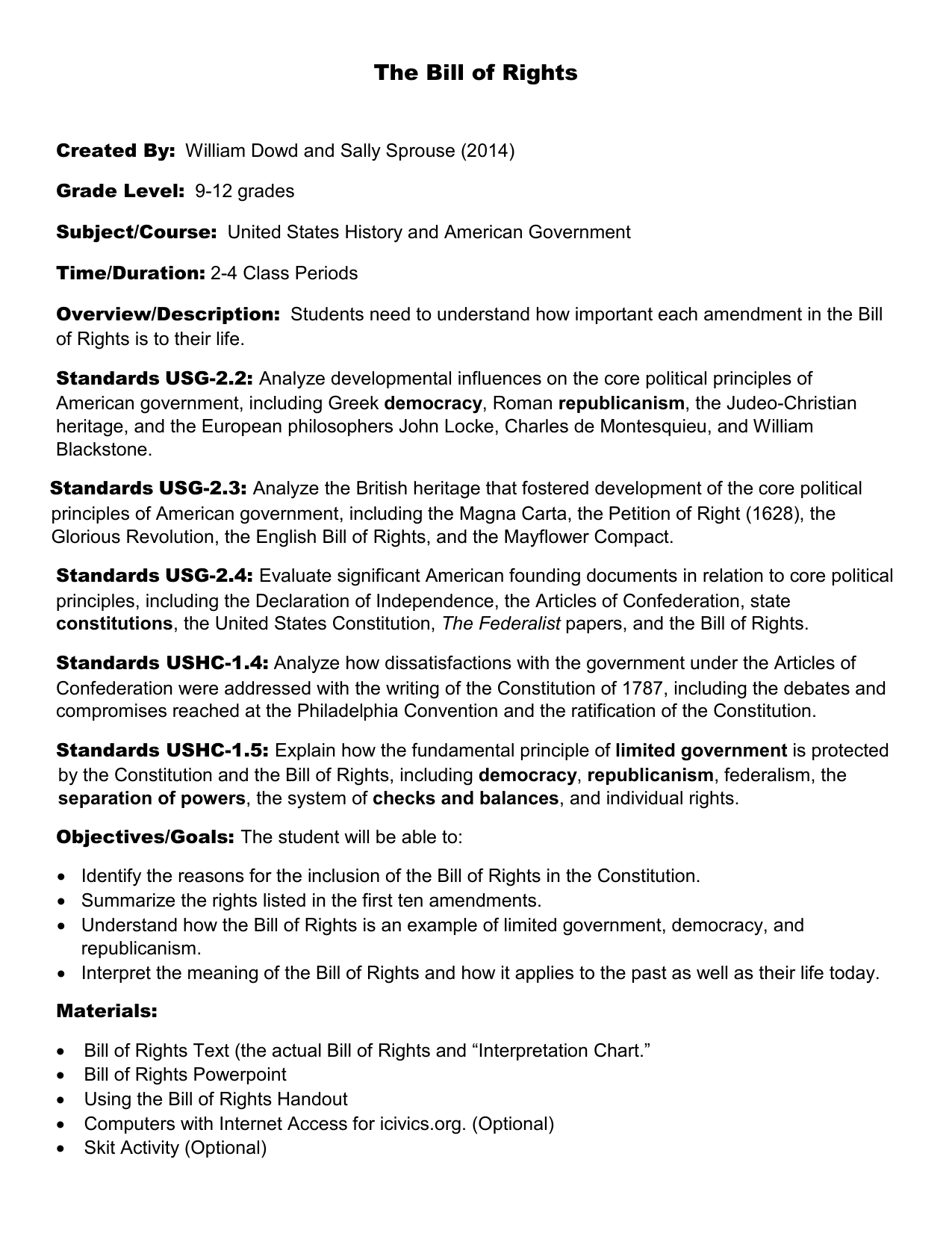

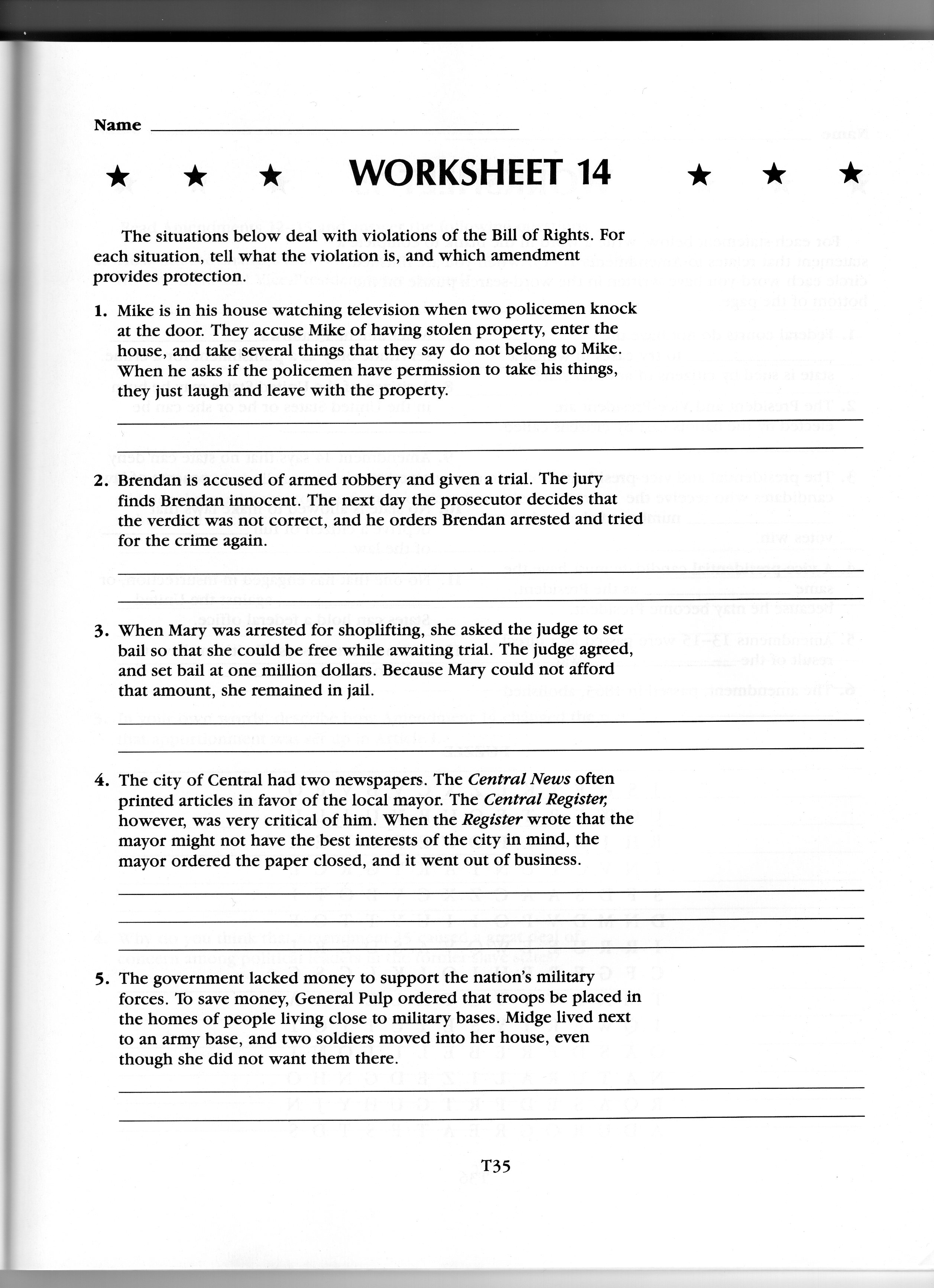

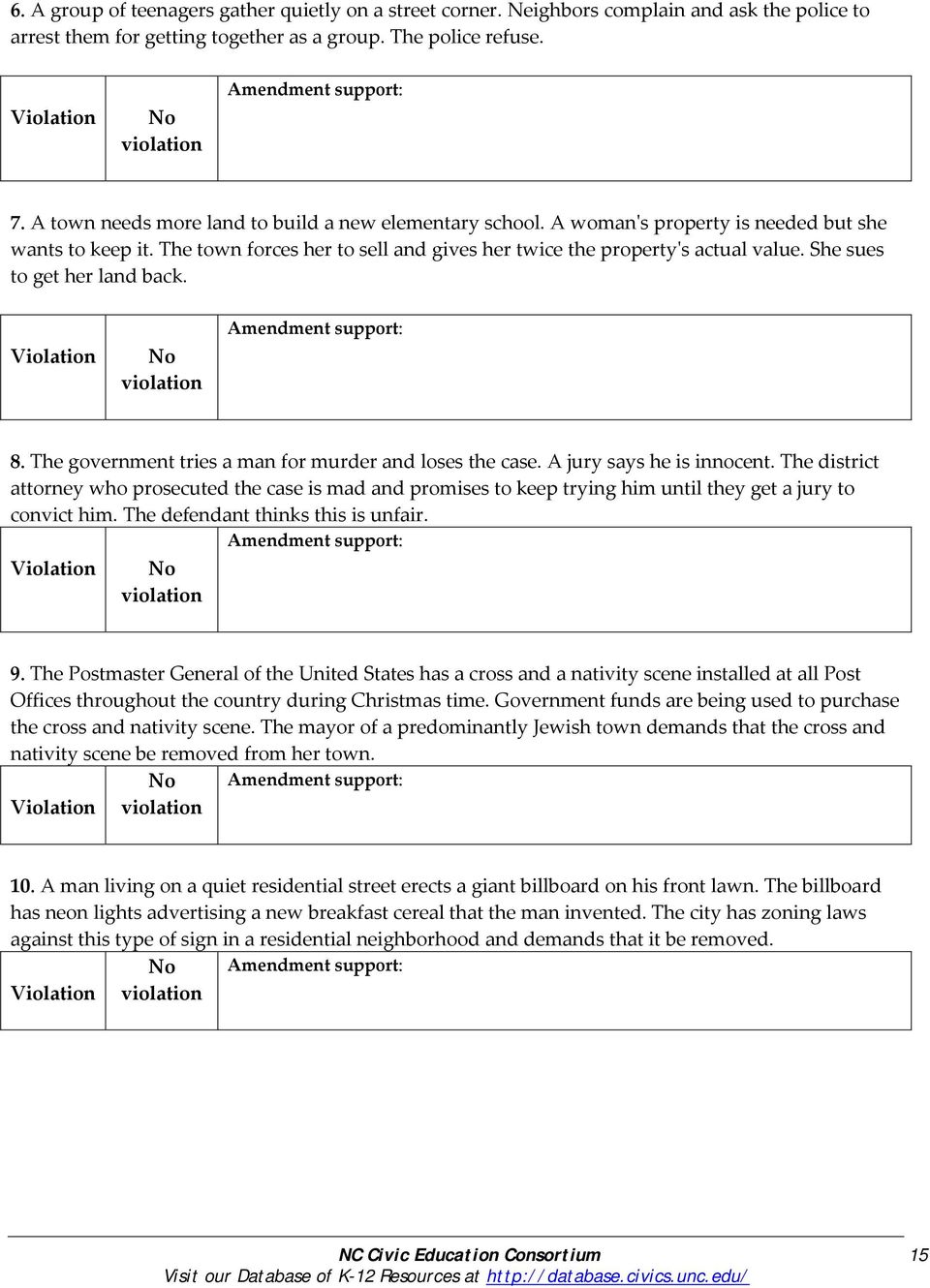

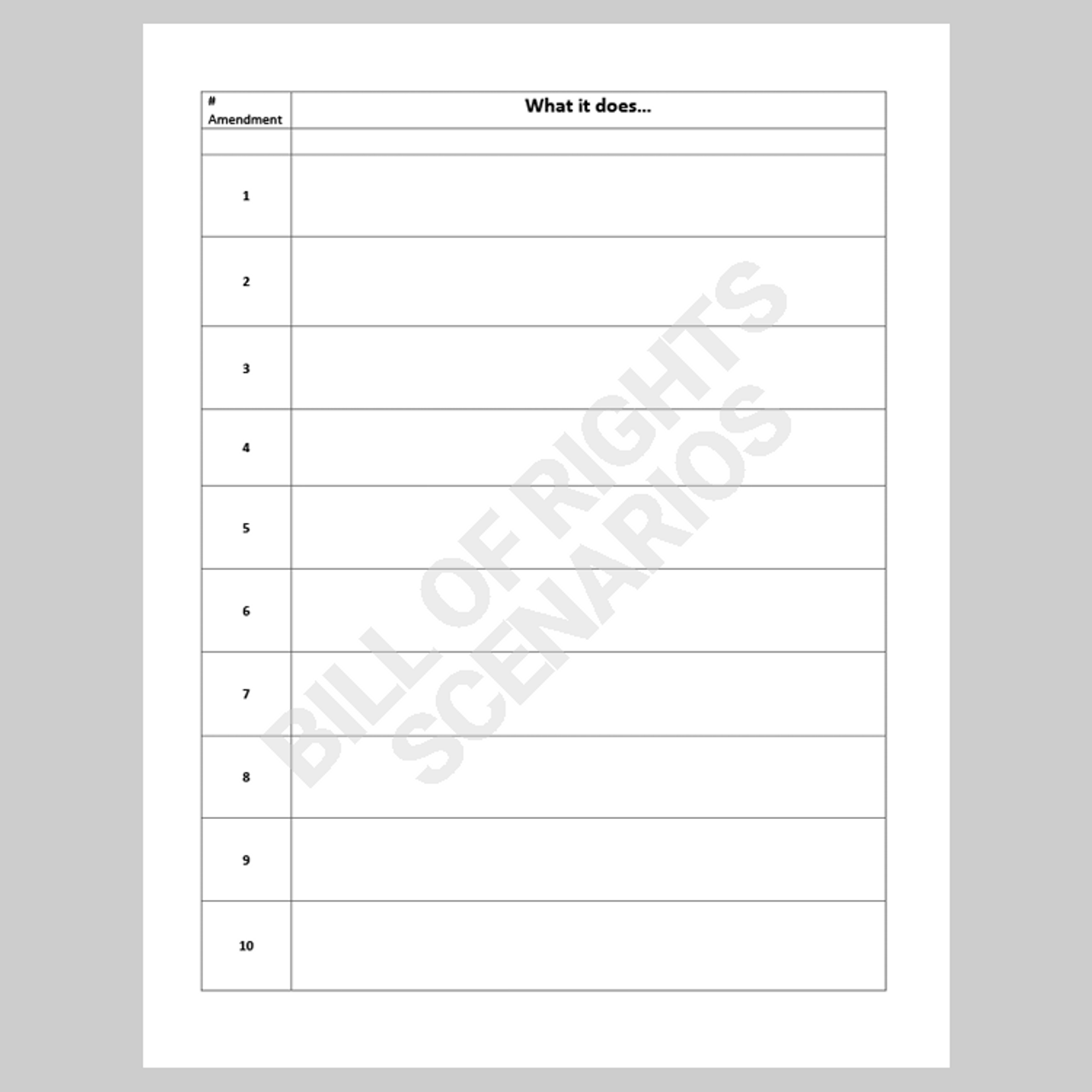

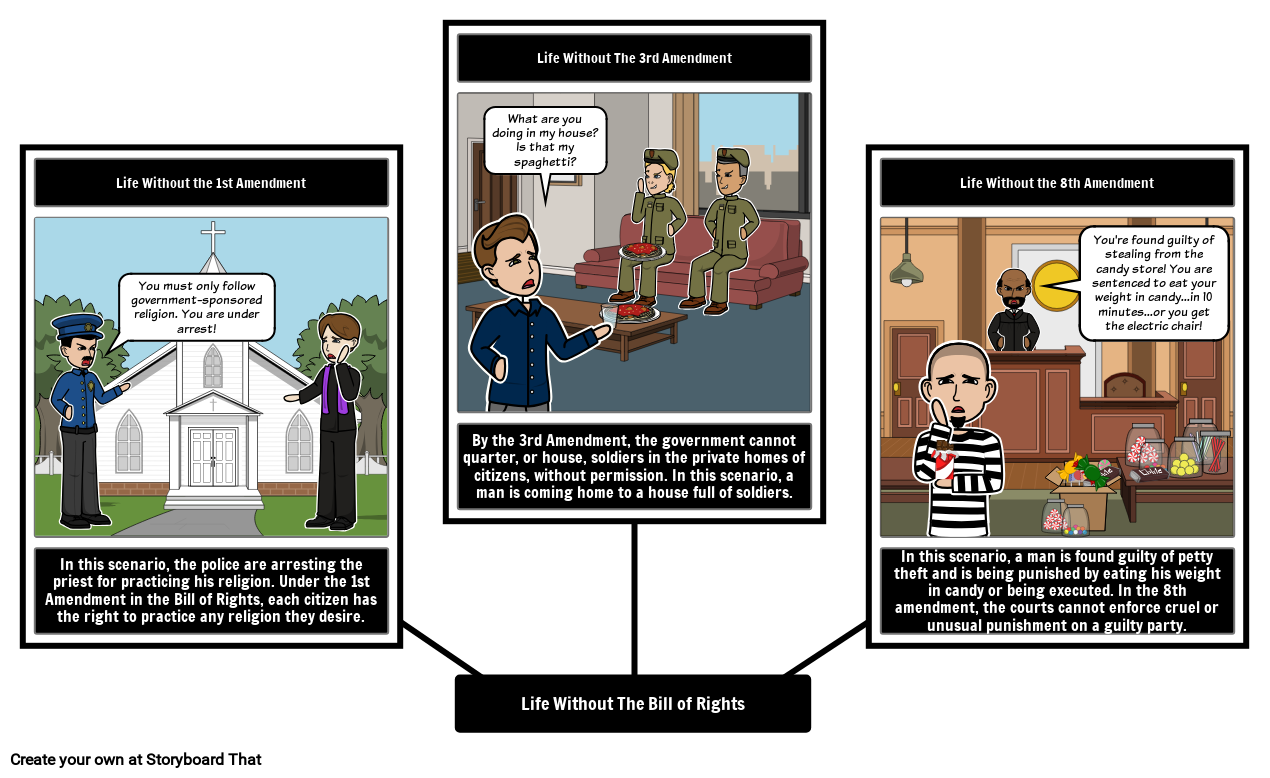

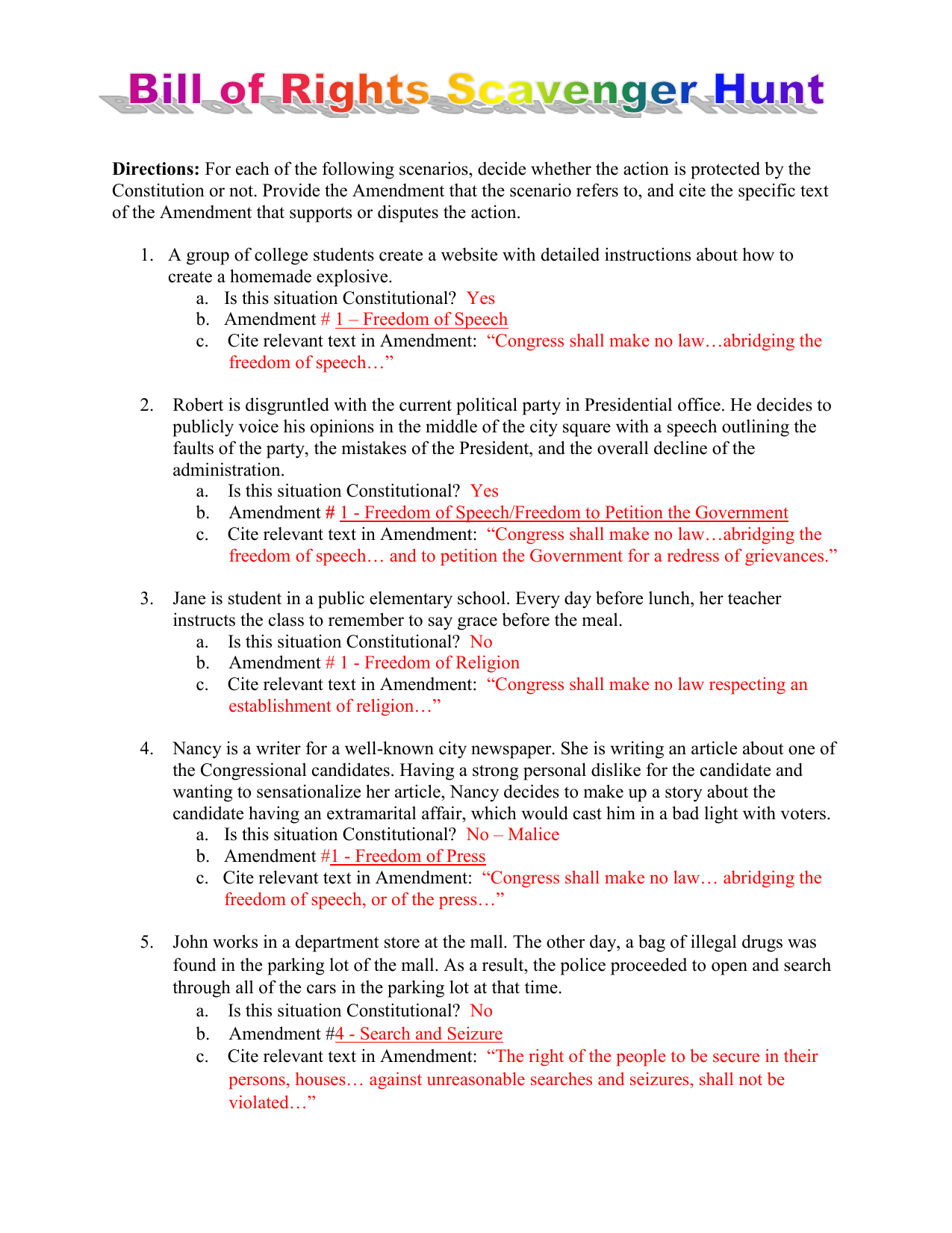

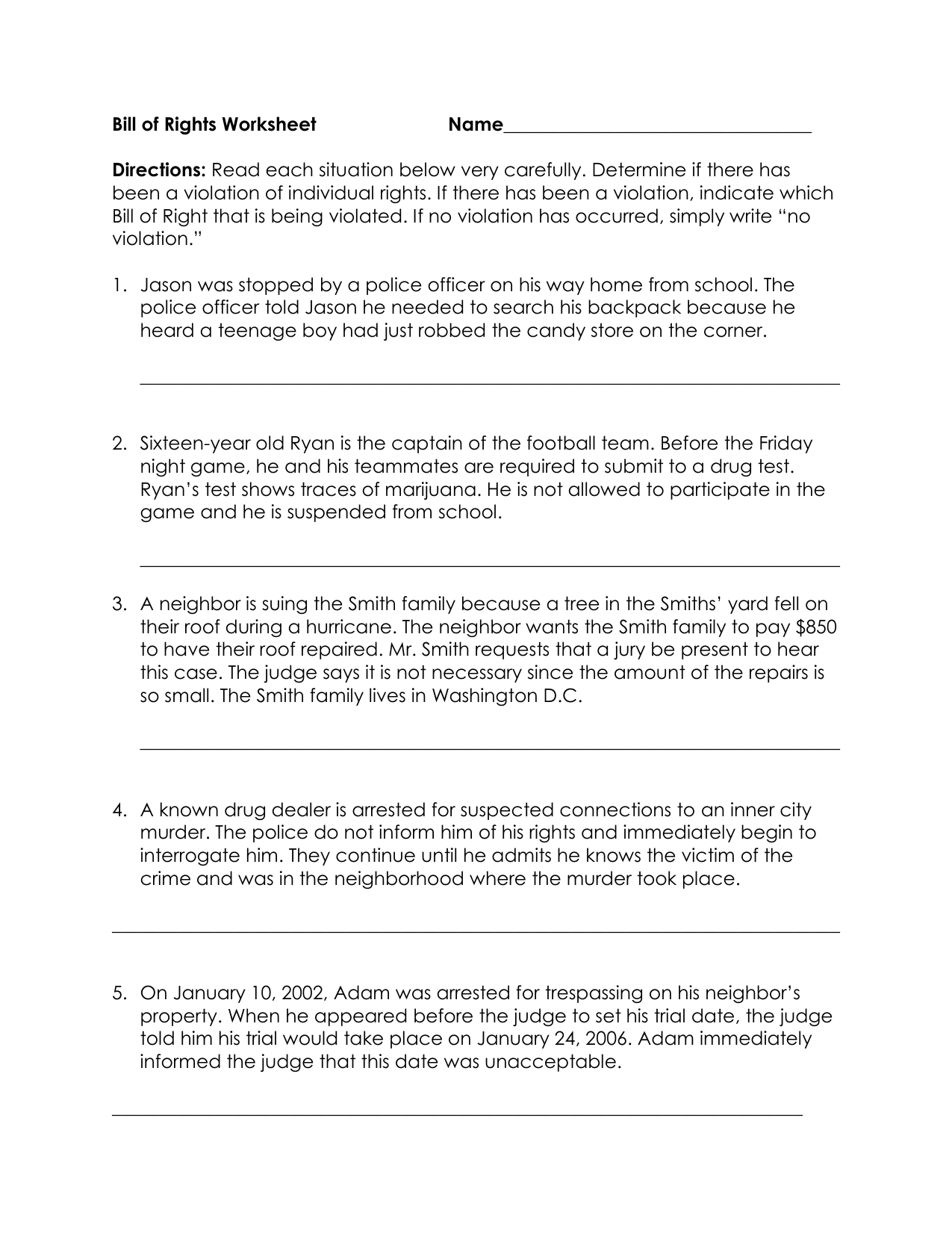

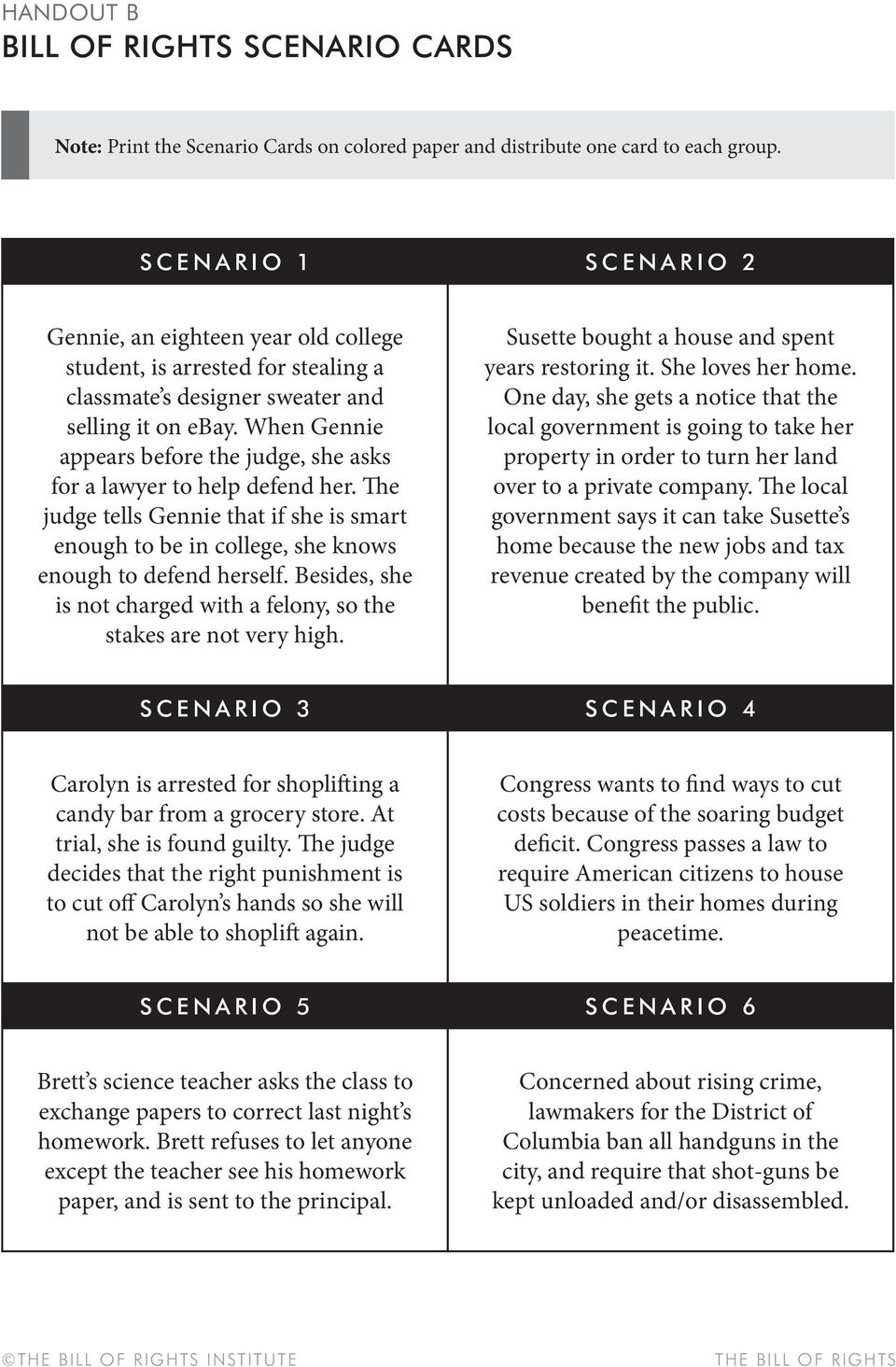

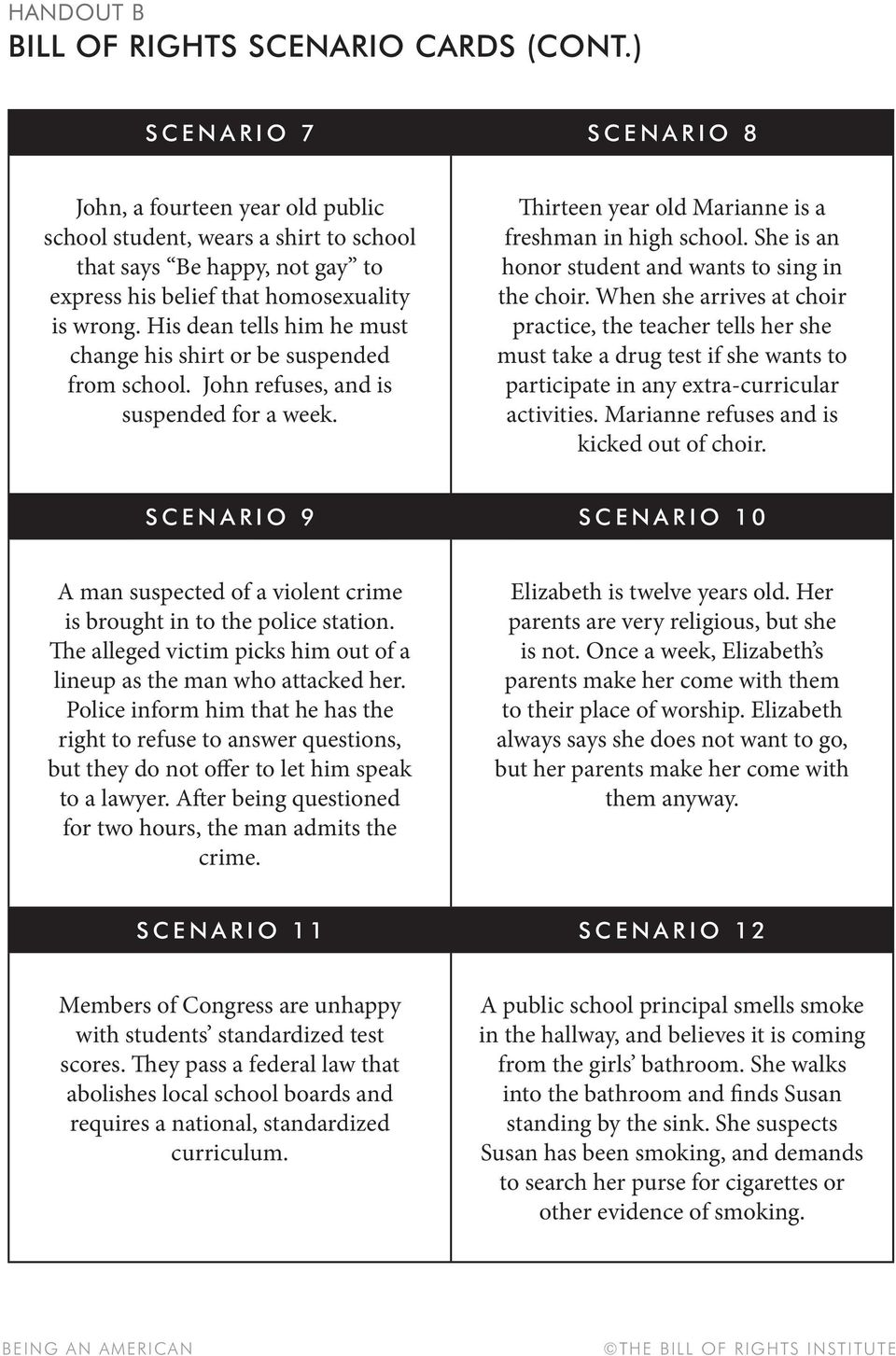

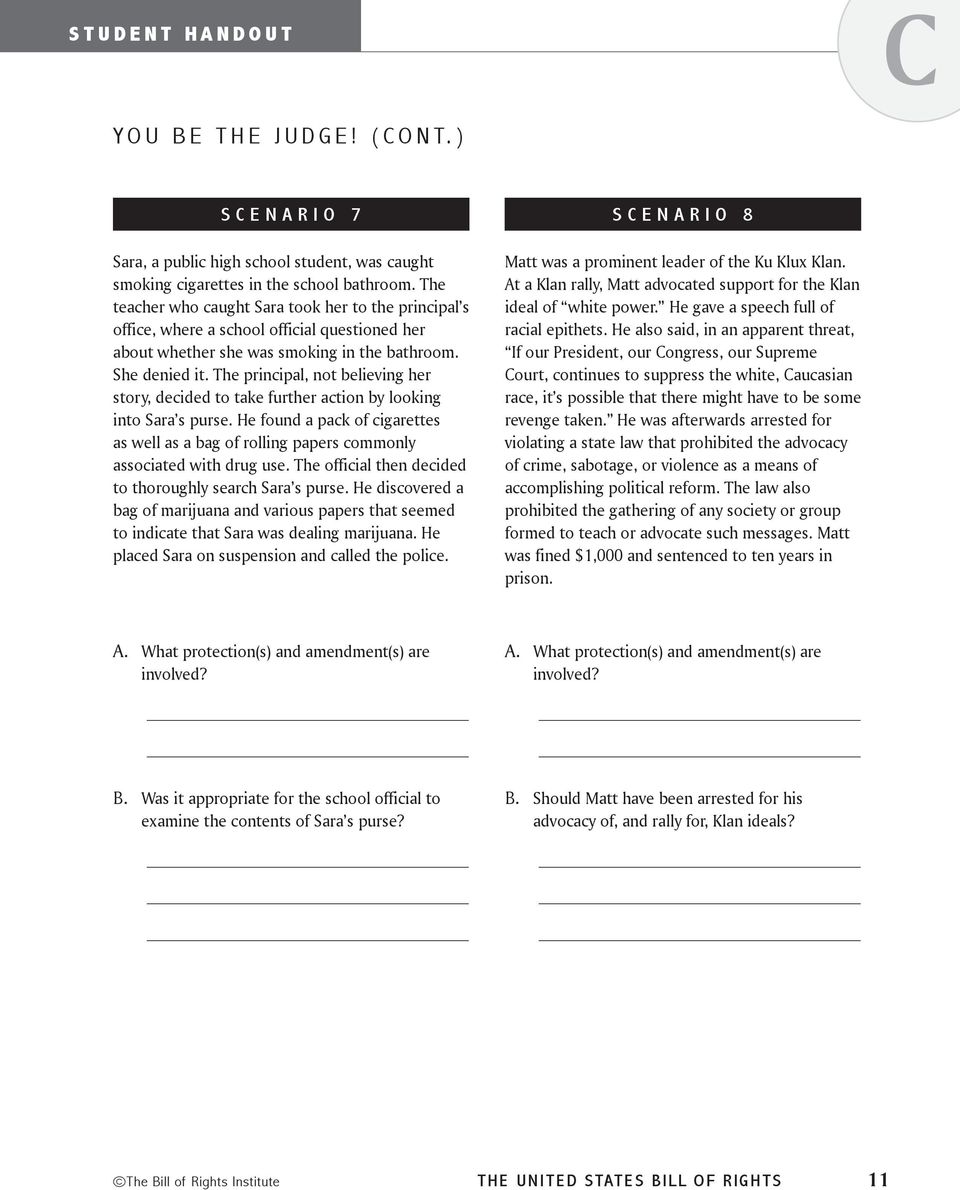

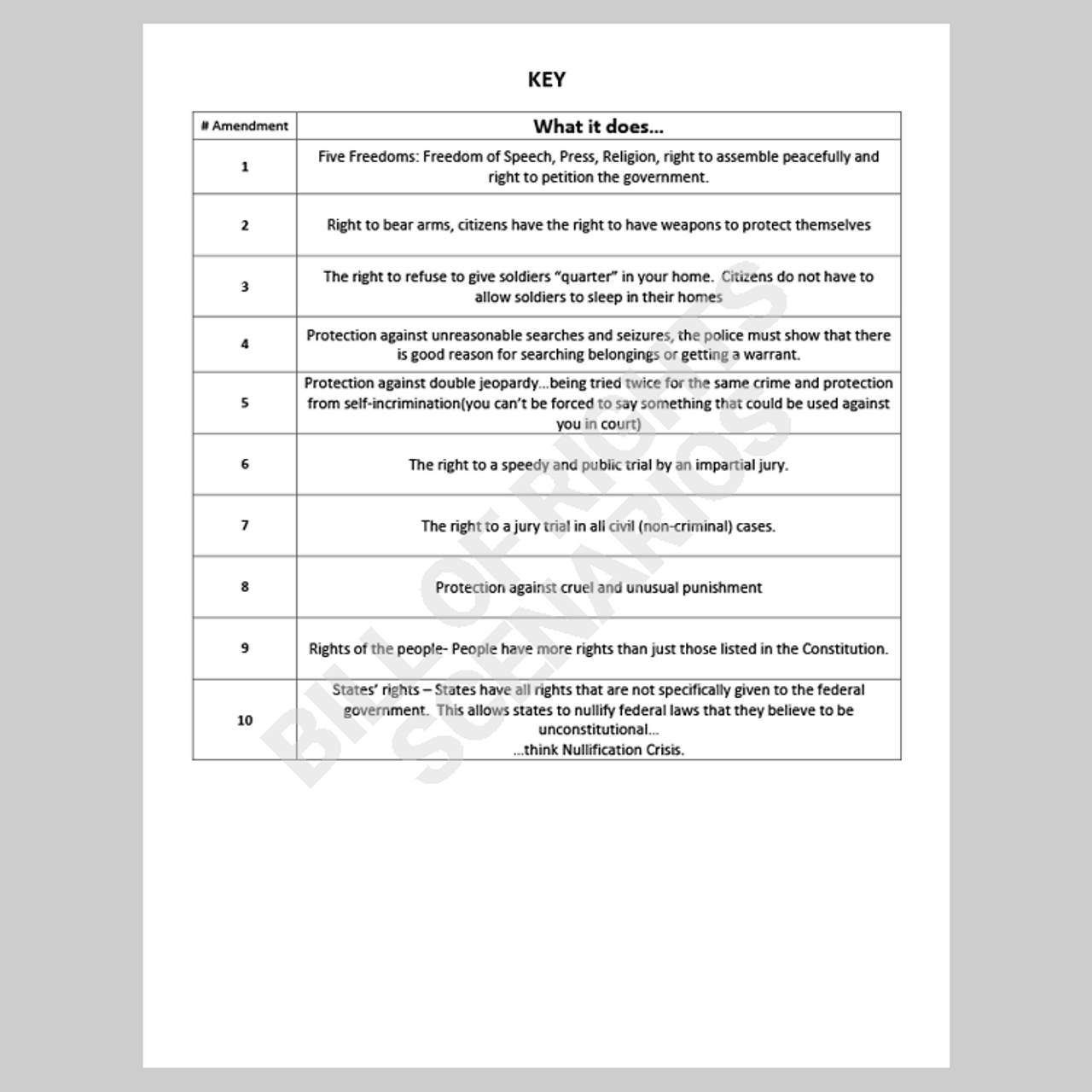

New Bill Of Rights Scenario Worksheet

Lovable Bill Of Rights Scenario Worksheet. If you desire to secure all of these great graphics about Bill Of Rights Scenario Worksheet, simply click save link to store the photos in your personal pc. These are ready for transfer, If you want and hope to obtain it, simply click save symbol in the web page, and it will be instantly downloaded to your desktop computer. Finally If you following to receive unique and the recent graphic related to Bill Of Rights Scenario Worksheet, occupy follow us upon google lead or bookmark the site, we try our best to come up with the money for you regular up grade next fresh and new images. We realize hope you enjoy keeping right here. For some upgrades and recent information more or less Bill Of Rights Scenario Worksheet pics, keep amused warmly follow us upon twitter, path, Instagram and google plus, or you mark this page upon bookmark area, We try to present you update periodically subsequently all additional and fresh images, like your exploring, and locate the right for you.

They have all the balances listed in a single worksheet that helps them put together the final yr statements with relative ease simply. In the same method, it also ensures that the company’s bookkeeper ensures that the company has subsequently carried out all of the changes. A piece of paper with rows and columns for recording financial data to be used in comparative evaluation. By default, any new workbook you create in Excel will include one worksheet, called Sheet1.

The standard possibility, Sheet, searches all of the cells within the at present active worksheet. If you need to proceed the search in the other worksheets in your workbook, select Workbook. Excel examines the worksheets from left to right. When it finishes looking the final worksheet, it loops again and begins examining the first worksheet. [newline]In computing, spreadsheet software presents, on a computer monitor, a person interface that resembles one or more paper accounting worksheets. A spreadsheet is basically a worksheet which is divided into rows and columns to store data; data from business inventories, income-expense report, and debit-credit calculations.

Bad worksheets make little or no sense to college students when used independently. Worksheets ought to be used as a learning tool NOT a instructing software. Some students will love impartial quiet time with a worksheet, however, the objective should be to construct on ideas already taught, to not educate them.