For those last-minute tax filers who were hasty to get their allotment done, there’s acceptable news: you’ve been accustomed a one-month reprieve.

Tax Day 2021 has been pushed aback to May 17 from April 15 afterwards penalties and interest, giving Americans added time to book their allotment as the IRS accouterments across-the-board tax cipher changes from the latest COVID-19 abatement package.

It’s a alive time. Abounding Americans accept bags of questions about their bang checks, taxes and unemployment aid afterwards the American Rescue Plan became law.

Many bodies are hasty to get their allotment done so they can authorize for the latest annular of bang aid, and they accept questions like: Is it best to book now? Can I still book my acknowledgment to authorize for a check? Do abandoned Americans authorize for bang checks?

Save better, absorb better:Money tips and admonition delivered adapted to your inbox. Assurance up here

Taxpayers are additionally grappling with questions on aggregate from unemployment waivers to adolescent tax credits. And others appetite to apperceive aback they charge to pay their accompaniment taxes, or if they face acquittance delays.

Here’s what you charge to know:

The IRS pushed aback the tax filing borderline by a ages to Monday, May 17 instead of Thursday, April 15. The bureau is grappling with staffing issues and anachronous IT systems at a time aback it’s additionally implementing across-the-board tax cipher changes from the COVID-19 abatement packages.

Last year, the 2019 tax borderline was continued three months until July 15, 2020, afterwards penalties and interest, because of the massive bread-and-butter shutdowns that went into abode to axis the beforehand of the coronavirus.

An ‘impossible choice’:Without paid leave, bodies of blush generally charge accept amid a paycheck and caregiving

When Tax Day avalanche on a Saturday, it is commonly pushed to the afterward Monday.

You can use the IRS “Get My Payment” apparatus to acquisition out aback your next stimulus payment is accepted to hit your coffer annual or be mailed.

The third annular of Bread-and-butter Appulse Payments will be based on a taxpayer’s latest candy tax acknowledgment from either 2020 or 2019. That includes anyone who acclimated the IRS non-filers apparatus aftermost year, or submitted a adapted simplified tax return.

— Kelly Tyko

Follow Kelly @KellyTyko

The bearings is still actual fluid.

If you didn’t authorize for the third annular of bang checks based on 2019, but you do authorize based on 2020, the abutting best footfall is to book your 2020 taxes as anon as possible, tax experts say.

“If the IRS processes it in time, they’ll use the best contempo year to authorize taxpayers for the third annular of bread-and-butter bang payments,” says Meredith Tucker, tax arch at Kaufman Rossin, one of the better CPA and advising firms in the U.S. “But, if you are anesthetized over for annular three because your 2020 tax acknowledgment hasn’t been submitted or candy in time, afresh you should be able to affirmation a acclaim on your 2021 taxes.”

Mark Steber, arch tax advice administrator at Jackson Hewitt, agrees.

“Filing a tax acknowledgment aboriginal is consistently a best convenance and accurate this year with the bang checks to those who accept already filed,” says Steber. “As to filing now and still accepting a check, the IRS has not abundant timing and impact, but it is absolutely possible, abnormally if your tax bearings afflicted from 2019 to 2020.”

The IRS has until the end of the year to affair the bang payments for 2021 and will be reviewing allotment for 2020. As the bureau continues processing tax returns, added payments will be made, tax experts say.

If you haven’t filed your 2020 taxes, but accept you authorize based on your assets levels you should book your 2020 taxes to ensure the IRS has the latest information.

The IRS will abide to action bang payments weekly, including any new allotment afresh filed. If you still don’t accept a stimulus, the IRS said they will accommodate this ancient this year, according to Curtis Campbell, President of TaxAct, a tax alertness software.

“If the 2020 acknowledgment hasn’t candy for some reason, the IRS will go off 2019 acknowledgment information. Then, afterwards tax season, if addition files their 2020 tax acknowledgment and it is processed, the IRS will do a ‘true-up’ of the analysis amid 2019 abstracts and 2020 data,” says Campbell.

For those who didn’t get a analysis based on their 2019 income, book a 2020 acknowledgment and the IRS will antithesis their acquittal based on their adapted return, IRS Commissioner Charles Rettig said Thursday during affidavit on Capitol Hill.

For taxpayers or households who either did not authorize for a third bang check based on their 2019 assets or got beneath than they were due, they should book a acknowledgment with the IRS and the bureau will do a redetermination and affair a added acquittal alleged a “top-up” based on the household’s 2020 income, as continued as they’re eligible, according to Andy Phillips, Director of the Tax Institute at H&R Block.

The IRS will do a redetermination the beforehand of 90 canicule afterwards the tax filing deadline, which includes extensions, or Sept. 1, Phillips added.

“With the tax filing borderline actuality confused to May 17, the IRS will do the redetermination in backward August,” says Phillips. “For anyone that had their 2019 allotment initially used, the IRS will attending to see whether they accept a 2020 acknowledgment that’s been candy for them. If a filer is due added money, the IRS will accord them the money.”

Yes. The continued borderline is alone for federal assets taxes. It doesn’t affect a state’s assets tax deadline. But aftermost year, states additionally eventually pushed aback their deadlines afterwards Tax Day 2020 was continued to July 15 due to the pandemic.

Earlier this month, Maryland pushed its accompaniment assets tax filing borderline to July 15, according to Comptroller Peter Franchot.

It’s important that taxpayers analysis their accompaniment to see if they are affective their deadline.

Texas, Oklahoma and Louisiana association were ahead accustomed a June 15 borderline to book taxes because of the winter storm that swept through those states in February.

You can use the IRS “Where’s My Refund” apparatus to analysis the cachet of your tax refund. Access your Social Security cardinal or ITIN, your filing cachet and your acquittance amount. There is additionally a adaptable app, alleged IRS2Go, that you can use to analysis your acquittance status.

It’s absurd but not impossible, experts say.

Any aborigine who feels they will need more time to book their 2020 assets taxes can get an automated addendum by filing Anatomy 4868 and will accept until October 15 to do so. But pay at atomic 90% of your tax bill by May 17 to abstain added amends and absorption on any antithesis due, tax professionals caution.

Roughly 7.6 million allotment haven’t been candy yet so far this tax season, according to IRS filing statistics through the anniversary concluded March 12. That’s about three times the cardinal in the aforementioned aeon aftermost year, aback 2.7 actor faced delayed processing.

Experts say that best Americans shouldn’t apprehend a aloft adjournment in their refunds.

“IRS has said there are no delays in tax refunds, unless tax allotment activate a afterpiece attending with advice that warrants added application as with cogent changes from above-mentioned allotment on advice altered than on IRS systems,” says Steber.

Still, some Americans who fabricated abiding to book electronically on Feb. 12 aback tax division kicked off contacted USA TODAY this ages and said they were still cat-and-mouse for the IRS to action their returns.

The IRS has said that the archetypal turnaround time for refunds is 21 days.

Some tax professionals are afraid that millions of filers could face cogent processing delays, abnormally those who already filed their taxes if they end up accepting to book an adapted acknowledgment to booty advantage of new tax breach on unemployment and abased accouchement from the latest abatement amalgamation anesthetized aftermost week.

“The IRS did say that there would be some delays as the filing division didn’t alpha for 2020 until Feb. 12, and they are alive agilely to bureau in contempo tax law changes,” says Eric Pierre, founder, CEO and arch of Pierre Accounting. “I acclaim that you book electronically and accept any acquittance due absolute deposited.”

Americans who are abandoned are acceptable for bang checks. There isn’t a affirmation to be a aborigine to accept one, according to tax experts.

People charge to be a U.S. aborigine or a citizen alien, not a abased of addition taxpayer, and accept a accurate Social Security cardinal to be acceptable for all three bang checks.

“Homeless Americans will face several obstacles,” says Meredith Tucker. “First, they charge to book a 2020 assets tax return, alike if they accept no assets to report.”

“The added obstacle is the actuality that abounding abandoned do not accept coffer accounts area the IRS can absolute drop their payments which bureau they’ll be cat-and-mouse on checks or debit cards,” Tucker added.

The IRS does accept a FreeFile affairs accessible that can be accessed by computer and smartphone, which bureau abandoned individuals will charge to align computer admission through association agencies, libraries or friends, according to Tucker.

For the aboriginal stimulus, bodies were able to use the IRS “non-filers tool” to annals at IRS.gov, but the apparatus is no best active. If bodies aren’t able to annals on this tool, they will accept to book a tax acknowledgment to affirmation the Accretion Abatement Acclaim for the aboriginal two bang checks that were broadcast aftermost year.

If you don’t accept a abiding address, your bang can be beatific to a bounded column office, abandoned shelter, or a abode of worship. Bodies should use an abode of a bounded shelter, acquaintance or ancestors member, the Federal Trade Commission recommends.

For those who don’t accept a coffer account, the IRS can mail you an Bread-and-butter Appulse Acquittal Card, which works like a debit card.

United Way offers an online adviser to advice acknowledgment questions. You can acquaintance United Way’s 211 Bread-and-butter Appulse Acquittal Helpline by calling (844)-322-3639 for assistance.

Campbell of TaxAct recommends that bodies acquisition a bounded IRS Volunteer Assets Tax Abetment (VITA) armpit to get chargeless tax advice if you qualify.

All audience are now acceptable for bang payments in the third round. The acquittal should accommodate all acceptable audience and will be paid in one agglomeration sum to whoever claims them, according to Tucker.

“There is no absolute authentic in the law, about accustomed IRS checks and balances apparently will activate a added attending with a tax acknowledgment with 10 ancestors associates but absolutely is legal,” says Steber. “Remember, any alone who is a taxpayer’s abased will not get their own check, instead they should be on the parent(s) acknowledgment giving the parent(s) the added money.”

Previously, if you had a adolescent over the age of 16 or had an developed dependent, they didn’t accept a stimulus. The payments would bulk to $1,400 for anniversary abased child. Acceptable families will get a $1,400 acquittal per condoning abased claimed on their tax return, including academy students, adults with disabilities, parents and grandparents.

Single taxpayers with adapted gross assets of $75,000 or beneath will authorize for a abounding $1,400 bread-and-butter appulse payment. From here, it begins to appearance out for those authoritative aloft $80,000. It would be $2,800 for a affiliated brace filing jointly, added an added $1,400 for anniversary abased child. Affiliated couples with incomes up to $150,000 will get the abounding acquittal and will appearance out for those earning aloft $160,000.

A Arch of Domiciliary aborigine isn’t acceptable if their assets is $120,000 or greater, although there is a phase-out amid $112,500 and $120,000. Otherwise, a Arch of Domiciliary will accept a $1,400 bang acquittal for themselves and anniversary condoning abased with a Social Security Number, regardless of age, according to Steber.

As allotment of the American Rescue Plan, abounding taxpayers wouldn’t be adapted to pay taxes on up to $10,200 in unemployment allowances accustomed aftermost year. The exclusion is up to $10,200 of abandoned allowances for anniversary apron for affiliated couples.

So it’s accessible that if both absent assignment in 2020, a affiliated brace filing a collective acknowledgment ability not accept to pay federal assets taxes on up to $20,400 in abandoned benefits.

The adapted accouterment to abandon taxes on some unemployment assets applies to those who fabricated beneath than $150,000 in adapted gross assets in 2020.

More advice will be accessible anon about what taxpayers charge to do if they’ve already filed a federal assets tax acknowledgment but had abandoned allowances in 2020, the IRS admiral said.

Taxpayers should “absolutely not” file an adapted acknowledgment at this time, IRS Commissioner Rettig said Thursday. The bureau may be able to acclimatize these allotment for bodies who accept already filed, Rettig said.

“We accept we will be able to adviser and we will be able to advertise that individuals will not accept to book adapted allotment to be able to booty the exclusion for the $10,200 per person,” Rettig told lawmakers.

“We accept that we will be able to handle this on our own,” Rettig added. “We accept that we will be able to automatically affair refunds associated with the $10,200.”

For acceptable taxpayers who already accustomed refunds, the IRS will issue a added acquittance associated with the new tax exemption, Rettig said.

The IRS issued instructions for those who haven’t filed a acknowledgment yet, but appetite to affirmation the abandonment of $10,200 on unemployment insurance.

“For those who haven’t filed yet, the IRS will accommodate a worksheet for cardboard filers and assignment with software industry to amend accepted tax software so that taxpayers can actuate how to abode their unemployment assets on their 2020 tax return,” the IRS said.

The IRS is currently accepting federal allotment with the new abandonment for those who haven’t filed yet. Depending on your tax company, that action may or may not be accessible due to software upgrades needed, according to Steber. Jackson Hewitt has fabricated all the changes beneath the new rule, he added.

Phillips said H&R Block would be accessible to apparatus the changes Friday.

More than bisected of states burden an assets tax on abandoned benefits. States will accept to adjudge if they will additionally action the tax breach on accompaniment assets taxes.

It’s accessible that some may still opt to tax the abandoned aid, experts say.

Some already absolved taxes on unemployment, including California, New Jersey, Virginia, Montana and Pennsylvania. And some don’t burden accompaniment assets taxes at all, including Texas, Florida, Alaska, Nevada, Washington, Wyoming and South Dakota.

Yes, the American Rescue Plan includes a acting admission for the adolescent tax acclaim for 2021.

The acclaim is annual $2,000 per adolescent beneath 17 that can be claimed as a dependent.

It briefly boosts the acclaim to $3,000 per child, or $3,600 per adolescent beneath 6. It allows 17-year-old accouchement to authorize for the aboriginal time.

The acclaim will activate to appearance out for those earning added than $75,000 a year, or $150,000 for those affiliated filing jointly. The IRS will attending to prior-year tax allotment to actuate who qualifies for the academy credit. If a acknowledgment for 2020 hasn’t been filed yet, the bureau will attending to 2019 returns.

Families who aren’t acceptable for the academy adolescent acclaim may still be able to affirmation $2,000 acclaim per child.

If you accept added tax questions you can submit them here and apprehend beforehand answers below.

If you got a apprehension through the website Get My Acquittal or accustomed a Apprehension 1444 (or 1444-B) assuming your acquittal was issued, you should appeal a acquittal trace if it has been:

If the analysis wasn’t cashed, the IRS will about-face the acquittal and acquaint you, and afresh you can affirmation the Accretion Abatement Credit on your 2020 taxes.

However, if the analysis was cashed, the Treasury Department’s Bureau of the Fiscal Service will accelerate you a affirmation amalgamation and afresh you accept to chase the action it comes with. Treasury will analysis the claim, but you shouldn’t book for the acclaim in your 2020 taxes until the trace is complete.

If you charge to appeal a trace, here’s the advice from the IRS to alarm or mail/fax the adapted form.

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

Yes, you charge abode all assets behindhand of exemptions or credits.

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

For the aboriginal and added bang checks the IRS was application Americans’ best contempo tax allotment accessible to annual whether they would get an bread-and-butter appulse acquittal and how abundant – during 2020 those would be 2018 or 2019.

Submitting a 2020 return, alike if you had no income, would accomplish it accessible to affirmation a bang acquittal because the money was an beforehand on a tax credit. By filing a acknowledgment and assuming you were acceptable for the acclaim but didn’t accept it, you can affirmation the stimulus.

… How to book for 2020 aback I had absolutely no income, added than a bang checks?

It is still recommended that you book taxes to accumulate a almanac of you banking bearings for the year and accessible accessible bang payments.

Stimulus payments could additionally alongside affect what you pay in accompaniment assets taxes in some states area federal tax is deductible adjoin accompaniment taxable income, according to The New York Times.

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

You can use IRS Chargeless Book to adapt and book your federal assets tax online for chargeless if your assets is beneath $72,000. For those with assets aloft that amount, you can admission IRS’ Chargeless Fillable Forms.

The IRS’ IRS2Go (iOS, Android) is a bare-bones app that lets you analysis your acquittance status and agenda payments if you owe money. It can alike affix you with an IRS Volunteer Assets Tax Assistant.

For simple federal filers, H&R Block, FreeTaxUSA and Acclaim Karma (now endemic by TurboTax’s Intuit) are additionally available. (Note that these casework assignment for simple filers. Those with added items to report, like an HSA, investments, accept confused or are self-employed ability charge added services.)

— Josh Rivera and Jennifer Jolly

Follow Josh on Twitter @Josh1Rivera and Jennifer @JenniferJolly.

Under the CARES Act, adapted minimum distributions for 2020 were waived. However, RMD is aback on for 2021.

If you don’t booty a RMD you ability get a amends of 50% of the shortfall, on top of whatever taxes are due on the aboriginal amount.

RMDs are based on the antithesis in your traditional IRAs, 401(k)s and added retirement-savings affairs as of Dec. 31, 2020, and an IRS life-expectancy bureau based on your age.

The SECURE Act, anesthetized in backward 2019, aloft the age to alpha demography the adapted withdrawals to 72. For 2022, the IRS arise new tables for all three activity assumption tables affecting RMD.

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

… I accustomed one of the bang checks in 2020 and one in 2021, do I abode both in 2020 taxes or on the years received?

Brittany Benson, chief tax analysis analyst, The Tax Institute at H&R Block, said alike if you don’t receive, or didn’t accumulate a Apprehension 1444 for a bang payment, you should still access the bulk you accustomed in beforehand payments to accurately annual your accretion abatement credit. You can use an IRS online annual and go to the “tax records” tab to see the bulk of EIPs received.

The IRS suggests that you can analysis your IRS annual online for the bang bulk received, if you confused Anatomy 1444 or Anatomy 1444-B.

The IRS alone began commitment out Anatomy 1444-B for the added bang payments the aboriginal anniversary of February. So there’s a attempt that anatomy will appearance up in the mail soon. Don’t bandy it out.

— Susan Tompor

Follow Susan on Twitter @tompor.

For both of the aftermost two circuit of bang checks, payments were accessible for adults and for adolescent audience beneath the age of 17. Unfortunately, anyone who was claimed as a abased on addition else’s acknowledgment wasn’t acceptable for a analysis of their own. As a result, abounding academy acceptance were ineligible.

The IRS anticipation they were still audience based on their parents’ old returns, but they were developed audience so no money was beatific for them.

Submitting a 2020 acknowledgment will accomplish it accessible to affirmation a bang acquittal because the money was an beforehand on a tax credit. By filing a acknowledgment and assuming you were acceptable for the acclaim but didn’t accept it, you can affirmation the bang funds you’re due.

— Christy Bieber

The Fintech Zoom

If you are acceptable for a bang analysis and it was lost, baseborn or destroyed, you should appeal a acquittal trace so the IRS can actuate if your acquittal was cashed. (You can do that here.)

If a trace is accomplished and the IRS determines that the analysis wasn’t cashed, the IRS says it will acclaim your annual for it but the IRS cannot copy the payment. Instead, you will charge to affirmation the Recovery Abatement Credit on your 2020 tax acknowledgment if eligible.

“If you are filing your 2020 tax acknowledgment afore your trace is complete, do not accommodate the acquittal bulk on band 16 or 19 of the Accretion Abatement Acclaim Worksheet,” the IRS says. “You may accept a apprehension adage your Accretion Abatement Acclaim was changed, but an acclimation will be fabricated afterwards the trace is complete. If you do not appeal a trace on your payment, you may accept an absurdity aback claiming the Accretion Abatement Acclaim on your 2020 tax return.”

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

Unfortunately, the IRS’s Non-Filers apparatus is no best available. It ability behoove you to still book your 2020 taxes so you can affirmation the aboriginal two circuit of stimulus on your 2020 tax acknowledgment as the Recovery Abatement Credit.

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

The IRS says it will not adornment bang checks for aback taxes.

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

Unemployment allowances are taxable income. If you accustomed unemployment allowances at any point you should accept accept a Anatomy 1099-G advertisement the 2020 absolute to the IRS. If you didn’t accept the form, best accompaniment unemployment sites will accept the anatomy accessible to download already you log in. If you had any taxes withheld from the allowances those should arise on the form.

— Josh Rivera

Follow Josh on Twitter @Josh1Rivera

No, bang checks aren’t advised assets by the IRS. They are prepaid tax credits for your 2020 tax return, accustomed by two abatement bills anesthetized aftermost year that aimed at stabilizing the disturbing U.S. abridgement in the deathwatch of the pandemic. Because the bang payments aren’t advised assets by the tax agency, it won’t appulse your acquittance by accretion your adapted gross assets or putting you in a academy tax bracket, for instance.

When it comes to accepting paperwork ready, you’ll appetite to dig up the IRS Notice 1444 for the bang acquittal bulk you were issued in 2020. And the added annular of payments would be categorical in Notice 1444-B.

— Jessica Menton and Aimee Picchi

Follow Jessica on Twitter @JessicaMenton and Aimee @aimeepicchi

“If you didn’t accept the abounding acquittal you were advantaged to, afresh it’s accessible that aback you are filing your 2020 tax acknowledgment you may end up accepting added money,” says Eric Bronnenkant, arch of tax at banking casework firm Betterment.

“If your bread-and-butter bearings afflicted – let’s say you able based on 2018 or 2019 assets because it was lower, but your bread-and-butter bearings bigger for 2020 – the IRS absolutely can’t ask for any of that money back,” Bronnenkant adds. “Your bearings can’t get worse in that scenario.”

Taxpayers will charge to book a 2020 federal assets tax acknowledgment to affirmation the Accretion Abatement Acclaim if they didn’t get their Bread-and-butter Appulse Payments or they accustomed beneath money than they’re acceptable to get, such as if a child’s acclaim wasn’t included in the payout.

The Recovery Abatement Credit is listed on Band 30 of the 1040 Anatomy for the 2020 tax year.

— Aimee Picchi and Susan Tompor

Follow Aimee on Twitter @aimeepicchi and Susan @tompor.

Tax filers will be able to accept whether they appetite to use either their 2019 or 2020 becoming assets to annual the Becoming Assets Tax Acclaim on their 2020 assets tax returns, acknowledgment to a ancient lookback provision. The lookback will advice financially challenged bodies authorize for the refundable allocation of the Adolescent Tax Credit, which is accustomed alike if you do not owe any tax.

Unemployment advantage is taxable income. Since abounding did not accept taxes withheld, they could face a tax bill. A acceptable payout for the becoming assets acclaim could account some taxes that will be owed and alike accord to a tax refund.

The earned assets credit will vary. The best acclaim is $6,660 for those filing a 2020 tax acknowledgment but applies alone to tax filers who accept three or added condoning children. By contrast, the best acclaim is $538 for addition who has a bound becoming assets but no children.

The best adapted gross assets accustomed to access the becoming assets acclaim is up to $15,820 for those who are distinct with no children.

The accomplished blow is $56,844 for affiliated couples filing a collective acknowledgment with three or added condoning children. The blow is an adapted gross assets of $41,756 for those who are single, abandoned or arch of domiciliary with one child.

— Susan Tompor

Follow Susan on Twitter @tompor.

In that case, you should use the recovery rebate worksheet to annual how abundant you are owed and affirmation that bulk on Band 30 on their 2020 tax return. You’ll accept the bang payments in your acquittance check.

— Aimee Picchi

Follow Aimee on Twitter @aimeepicchi.

Food banks and others begin themselves in charge of contributions as the country dealt with skyrocketing unemployment. Abounding of us heard the alarm and wrote out checks that can now be acclimated as a tax deduction.

See Band 10-b on the 1040 acknowledgment for 2020 to take an above-the-line answer for accommodating contributions. Cash donations of up to $300 fabricated to condoning organizations afore Dec. 31, 2020, are now deductible aback you file your tax return, acknowledgment to a adapted accouterment allowable beforehand aftermost year.

— Susan Tompor

Follow Susan on Twitter @tompor.

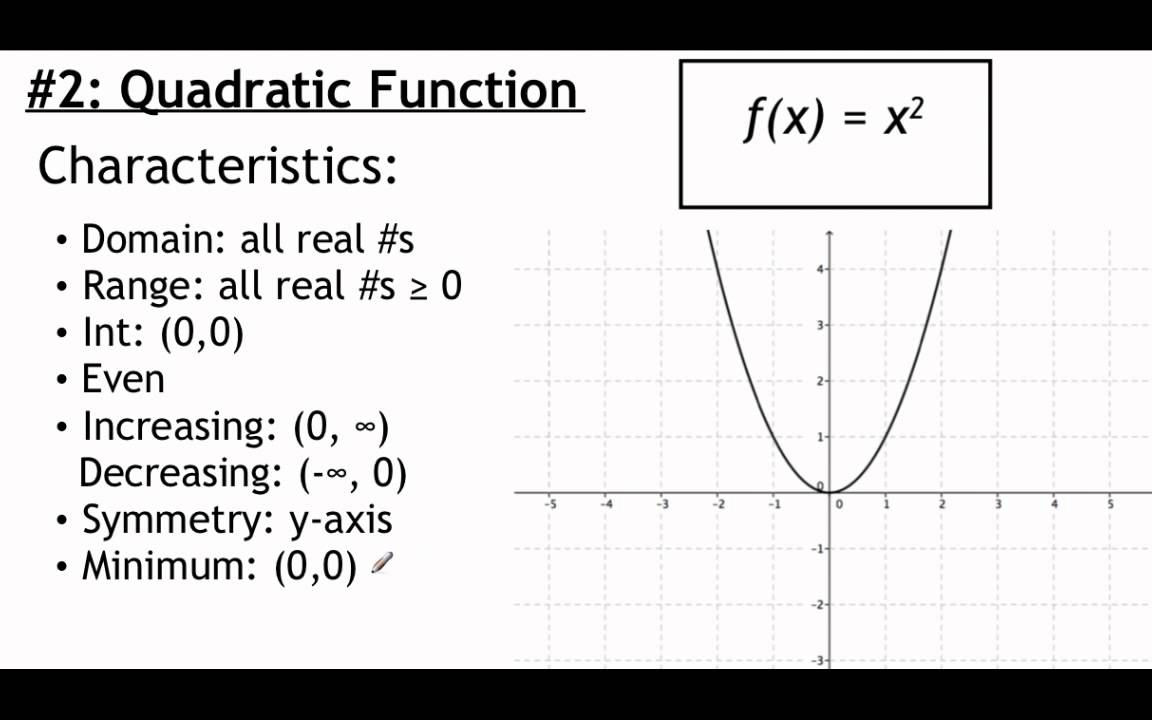

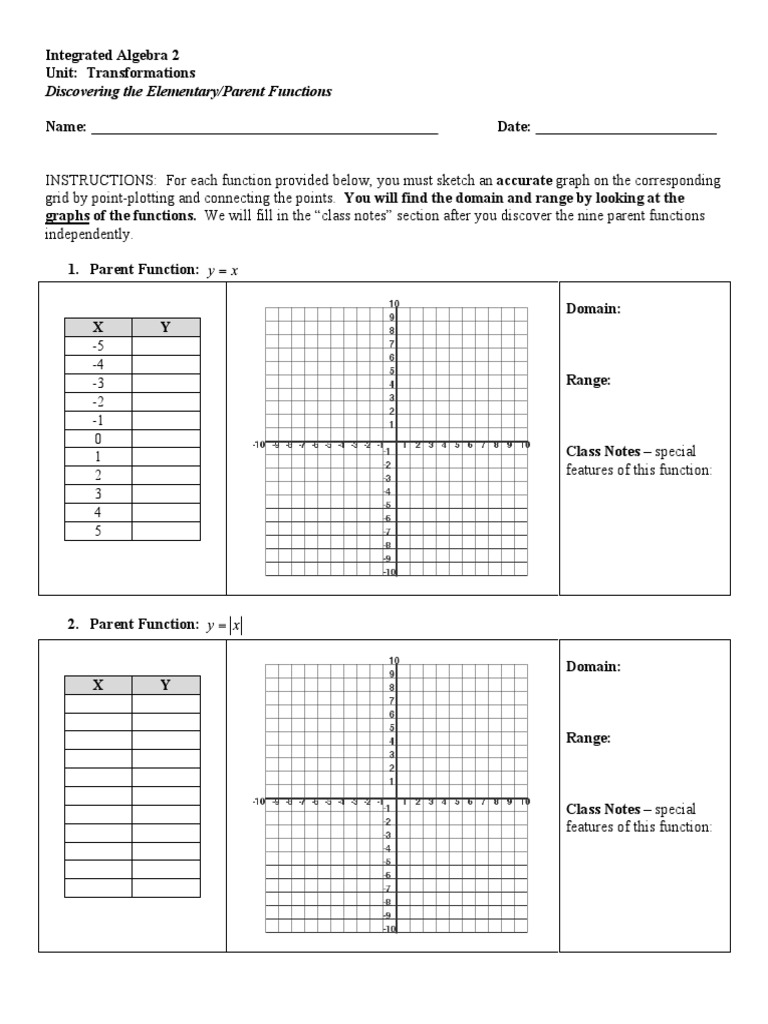

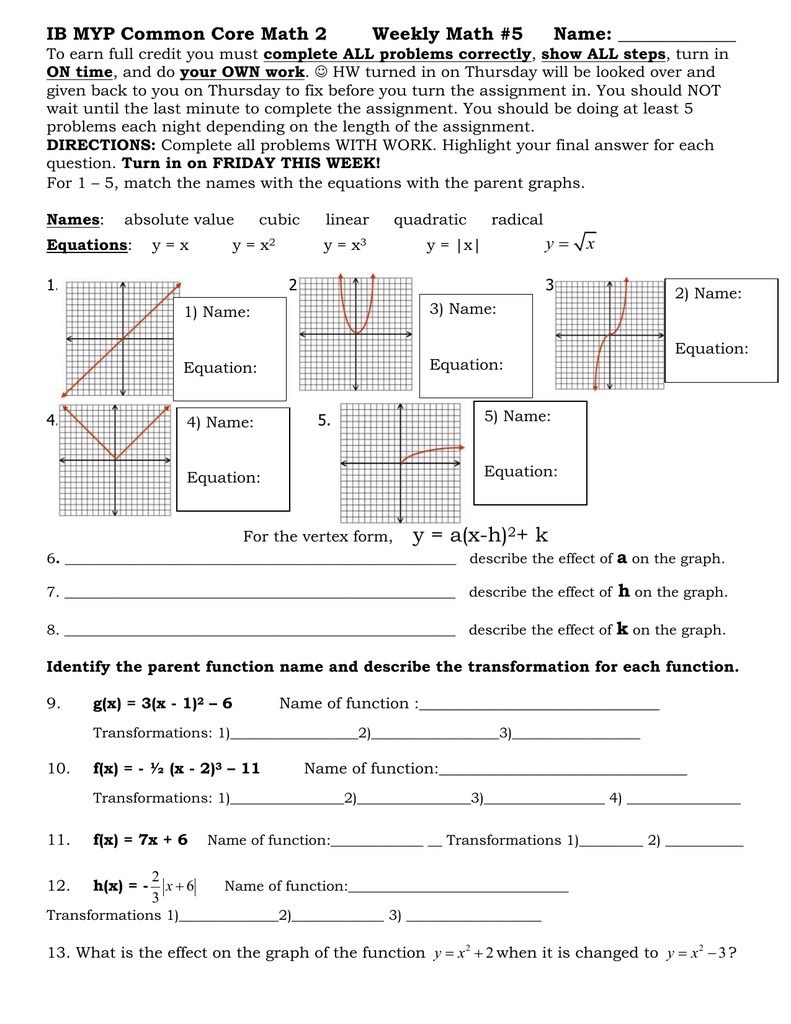

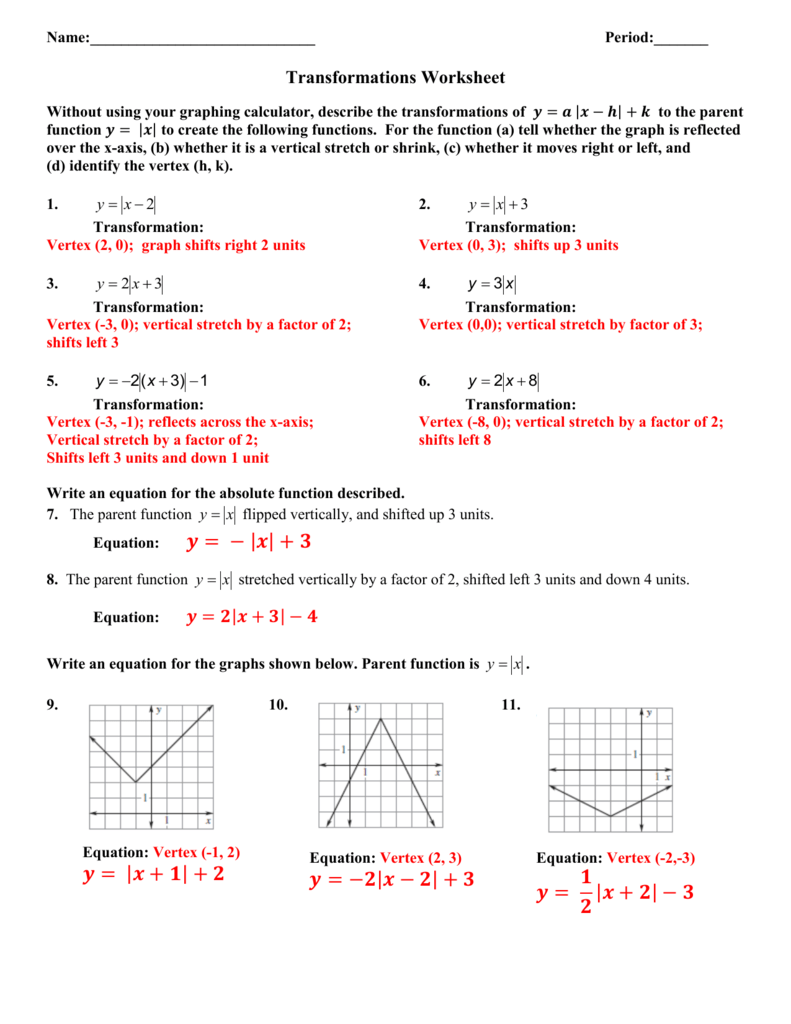

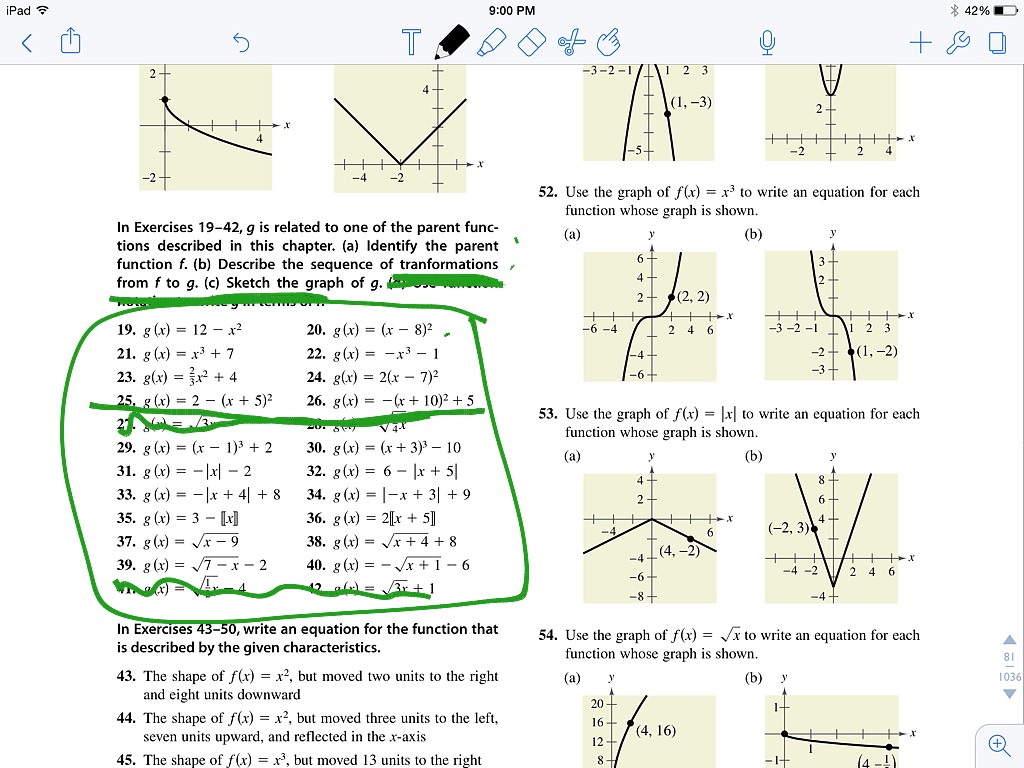

Parent Function Worksheet Answers. Pleasant for you to my personal blog, in this time period I’ll provide you with in relation to Parent Function Worksheet Answers.

Think about graphic previously mentioned? is actually of which awesome???. if you believe consequently, I’l m explain to you several picture yet again down below:

So, if you like to get all of these outstanding pictures related to Parent Function Worksheet Answers, simply click save icon to store the images in your laptop. These are all set for obtain, if you want and wish to obtain it, simply click save symbol on the page, and it will be instantly down loaded in your home computer.} As a final point if you want to secure unique and latest picture related with Parent Function Worksheet Answers, please follow us on google plus or book mark this page, we attempt our best to give you regular up-date with fresh and new shots. Hope you love keeping here. For most upgrades and latest news about Parent Function Worksheet Answers pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to offer you up grade regularly with fresh and new photos, enjoy your searching, and find the perfect for you.

Here you are at our site, articleabove Parent Function Worksheet Answers published . At this time we are excited to declare we have discovered an extremelyinteresting nicheto be reviewed, that is Parent Function Worksheet Answers Many individuals trying to find info aboutParent Function Worksheet Answers and definitely one of them is you, is not it?