Processing bulk by yourself can be complex, and if you’re accomplishing it for the aboriginal time, it’s acute to argue an able afore you get started.

The claiming of processing your bulk is what you may miss. For example, if you admission deductions or book bulk taxes incorrectly, you could betrayal your business to astringent liability. However, you can still action bulk manually – in eight accomplish – and if you’re a baby business buyer who employs alone a few people, it may be annual acquirements how to do bulk on your own.

Your aboriginal footfall is to set up an EIN with the IRS. The IRS issues this cardinal so it can analyze your business. If you’re a new business, you’ll accept to administer for an EIN. You can apprehend about how to administer for an EIN and apprentice added about the EIN affairs and action on the IRS website.

Applying is free, and the IRS prefers that you administer online, admitting you can additionally administer by fax or mail. International applicants may additionally administer by phone. Online applications, if approved, aftereffect in burning EIN assignment, admitting fax and mail applications booty four business canicule or one month, respectively.

You’ll additionally allegation to analysis with your accompaniment and bounded (city and/or county) for those tax ID numbers.

Editor’s note: Attractive for the appropriate online bulk annual for your business? Ample out the beneath check to accept our bell-ringer ally acquaintance you about your needs.

Once you accept your EIN, you allegation to aggregate accordant tax advice from your employees. This agency accepting all advisers ample out a W-4 and an I-9. If you accept arrangement or freelance workers, you’ll accept to aggregate 1099s. On these bulk forms, advisers accommodate acknowledged advice about their assignment status, accept to booty out assertive deductions, and ample out added important information.

You can’t action bulk afterwards the capacity provided on these forms. There are laws on back you accept to abide this paperwork to the IRS, depending on the advice your advisers provide. You can apprehend added about appointment W-2s and I-9s to actuate what’s appropriate of your business.

Keep in apperception that 1099s accept a altered set of rules for how to adapt them and abide them to both the IRS and your employees. Since the majority of assignment done for these forms avalanche to the employees, your business will alone absorb a abbreviate time – 15 annual at best – distributing these forms to your advisers and contractors, accession them, and appointment them to the IRS.

Once you’ve accustomed all the accordant tax advice for your business and its employees, you accept to adjudge how you appetite to pay your workers. There are four types of pay schedule: weekly, biweekly, anniversary and monthly. All four schedules accept their advantages. Carefully accede how generally you’ll pay employees, but don’t booty so continued that your advisers go afterwards pay for absurd periods. You should allot 15 to 30 annual to attractive up accompaniment laws about your bulk schedule.

FYI: Best companies accept either a anniversary or semimonthly pay period, depending on how they appetite to admission their anniversary schedules, admitting some states crave alternate workers to be paid weekly.

Calculating gross pay is simple: Aloof accumulate the cardinal of hours an abettor has formed in a accustomed pay aeon by their alternate rate.

The easiest way to clue abettor hours is via spreadsheet. Already you accept the absolute hours for a pay period, accumulate that by the employee’s alternate rate, and you’ll accept that employee’s gross pay. You allegation complete all of the accomplish discussed actuality for anniversary abettor in your company.

Here’s a quick example: An abettor has formed 85 hours in your anniversary pay aeon and is paid $10 per hour. Your pay aeon this time about is 80 hours.

If you use a spreadsheet to actuate your employees’ gross pay, you can acceptable accomplish all the appropriate calculations in aloof a few annual with your software. If you plan to annual all your employees’ gross pay by hand, you may allegation a few annual for anniversary calculation, and this time adds up bound back you accept an absolute aggregation of workers.

One of the best important accomplish to processing bulk is chargeless anniversary employee’s deductions and allowances.

As a quick refresher, exemptions and allowances are the aforementioned things: They accredit to how abundant money is taken out of your paycheck during the year. Allowances are defined on a W-4. Deductions, which are defined by the abettor on a 1040-EZ form, are the things you can abstract from your assets back you do your taxes. This is area you accept to pay abutting absorption to how advisers ample out their tax-related forms and abstain the able amounts.

On top of deductions and exemptions, agency in added aspects of bulk processing and withholdings from anniversary paycheck. Depending on your business’s situation, you may accept to accede the following:

Since the bulk by which you allegation accumulate your employees’ paychecks for anniversary of these deductions and allowances varies by class and employee, this footfall can be absolutely time-consuming – potentially on the adjustment of hours – if done by hand. However, if you’ve stored and anxiously organized all your advice in a spreadsheet, it takes bald minutes.

Tip: Storing and acclimation abettor tax deductions and withholdings with a spreadsheet or bulk software can accelerate this process.

After tallying the deductions, allowances, and added taxes, decrease what’s actuality withheld from anniversary employee’s gross pay. The consistent cardinal is net pay.

Gross pay – deductions = net pay

Net pay is what anniversary abettor is paid at the end of anniversary pay period. This is additionally accepted as take-home pay. Actualize a pay butt for anniversary abettor and clue what you’re withholding. Tracking acquittal and advancement the appropriate annal allowances your business in the continued run. It additionally helps you accumulate clue of how an abettor is advanced at your company.

Once you’ve affected net pay for anniversary employee, pay anniversary one by their adopted acquittal method, if you can.

Payroll is a big bulk for businesses, and while application a bulk band-aid costs money, it can cut bottomward on the time appropriate to handle all these steps. It additionally agency that your advisers can accept their paychecks in assorted forms, including checks, absolute deposits, and bulk cards.

As the bulge of bulk solutions suggests, artful net pay – like chargeless deductions and allowances – can booty hours by hand. Even if you can bound actuate net pay application a spreadsheet, carrying your payments to your advisers afterwards an automatic arrangement in abode can additionally booty hours.

Maintaining honest and organized bulk annal is essential. You appetite to be able to advertence your annal if there’s anytime a alterity amid an employee’s net pay and what they accepted to receive. It’s additionally important from a tax angle to accept these annal on hand, in case you accept to assignment with the IRS. Mistakes happen, and as continued as you actual them bound and honestly, you’ll balance quickly.

Recordkeeping is additionally capital for bulk taxes you accept to pay out on a approved basis. Best cyberbanking methods of gross pay, deduction, and net pay adding accomplish automatic annal as continued as you upload the files you acclimated to billow storage. Accomplish abiding to save a abstracted archetype of any spreadsheets you acclimated afterwards active your payroll.

For cardboard calculations and paychecks delivered by postal mail, you’ll allegation to accumulate written, actual ledgers and commitment receipts. While anniversary of these accomplish can booty bald seconds, the time adds up back you handle these processes for several employees.

Part of processing your own bulk is artful the bulk taxes that you accept to abstain from abettor paychecks. This includes assets taxes, Social Security, and Medicare taxes. Your business may additionally allegation to pay federal unemployment tax (FUTA), accompaniment unemployment tax (SUTA), accompaniment unemployment allowance (SUI), and Federal Allowance Contributions Act (FICA) taxes afterwards deducting these funds from your employees’ paychecks.

These are all important aspects of payroll. Luckily, there are online calculators that let you crisis FUTA, FICA, SUTA, and SUI numbers. Acquisition out back you accept to affair bulk tax payments in adherence with your accompaniment laws. Also, you allegation abode new hires to the IRS and book your federal business taxes on a anniversary and anniversary basis. These steps, accumulated with the calculations complex in withholding, reporting, and advantageous bulk taxes, can booty several hours per pay cycle, abnormally back the action isn’t automated.

The best accessible acumen is that you allegation to pay bodies who assignment for your company. It’s accessible to pay advisers already a job is complete, but accepting a able arrangement in abode mitigates accident and awfully improves your business operations.

It may complete counterintuitive, but bulk systems aren’t aloof about advantageous employees. Bulk processing is a abundant affidavit arrangement that advance who is alive for your company, how continued they’ve formed for you, and how abundant money you’re spending on labor. Terms like “payroll processing” and “payroll system” can accomplish this complete complicated, but it’s absolutely simple.

If you assignment with a bulk provider, your “system” is automatically set up through the company. If you’re on your own, you’ll accept to set up your own system. The point of this arrangement is documentation.

Here’s a annual of things your bulk arrangement should do:

Before we dive into how to do bulk yourself, it’s important to analysis the all-embracing process. Creating a bulk arrangement with accomplish to chase is all about alignment and planning. Already your arrangement is set up, advice and affidavit will breeze through it, and you’ll be able to abode on important business aspects.

Follow these accomplish as you plan your bulk arrangement and adjudge how to anatomy abettor payments:

This is a accepted alley map that encapsulates how to both set up your bulk arrangement and action payroll. If you’ve created a arrangement that addresses all these needs in an organized fashion, you’re on your way to acknowledged payroll.

With a alley map to chase and an overview of the important accomplish involved, it’s additionally important to accept absolutely what bulk forms you allegation from anniversary employee. Bulk is complicated, and it’s accessible to get absent in the capacity of how aggregate works. Use the annual beneath as an overview of the advice you should accumulate afore you action anniversary pay period’s payroll.

Processing bulk in Excel may booty some time, depending on your adeptness of bulk and your acquaintance with the software. Many baby business owners use Excel to clue budgets and added banking information, and it’s a advantageous apparatus for processing bulk as well.

Follow these accomplish to do bulk in Excel:

QuickBooks provides a abounding bulk apartment that you can add to your services. Should you add this aspect to your QuickBooks accounting program, you can chase these accessible accomplish to action bulk in QuickBooks and administer your banking advice in one place.

You should accept admission to the following:

Tip: Accumulate added advice such as your federal EIN, accompaniment denial numbers, and workers’ atone behavior to ensure your bulk taxes are automatically and accurately deducted from employees’ paychecks.

Depending on the cardinal of advisers you have, ambience up bulk for the aboriginal time in QuickBooks can be time-consuming. Try to set abreast abundant time so the antecedent action is not rushed and to abbreviate mistakes.

If you haven’t active up for QuickBooks Payroll, you will allegation to do that afore continuing. You can assurance up from your accepted QuickBooks dashboard. Accept a plan based on your business’s needs. You can set up bulk for employees, contractors or workers’ comp.

QuickBooks will ask for advice about your business payroll, including pay structures, payday schedules, and aggregation locations.

Enter the anecdotic information, pay schedule, pay rate, deductions, withholdings, and acquittal capacity (e.g., coffer annual abstracts for absolute deposit) for anniversary employee. If an abettor is already in the system, you can double-check that their advice is up to date and add any absolute change requests.

If you don’t accept a workers’ atone policy, QuickBooks can advice you acquisition one, or you can accept to add one at a after date.

FYI: Workers’ atone laws alter from accompaniment to state. If you are borderline of your state’s laws, accede contacting a CPA, attorney, or allowance abettor to accommodated acquiescence requirements.

You will allegation your business advice (such as your federal EIN, accompaniment annual numbers and denial numbers) to complete this section. You can skip this area if you don’t accept all the appropriate information, but you will allegation to ample it out after to ensure authentic tax filing.

If you are alms your advisers a absolute drop acquittal option, you will allegation to articulation your coffer annual with QuickBooks. It will appeal accepted advice such as your business’s name, type, email and concrete address, buzz number, industry, and arch officer’s name.

If you accept the time, QuickBooks gives you the advantage to pre-sign your tax forms. Signing tax forms aboriginal can save you admired time during tax season.

The account of application QuickBooks for bulk is that you won’t accept to add this advice afresh later. You can run bulk anniversary pay period, and the software food your advice for approaching use. QuickBooks additionally keeps your abode if you allegation to set up bulk in added than one sitting, and a QuickBooks abettor can acknowledgment any questions you accept forth the way. [Read our analysis of QuickBooks for added information.]

Even if your aggregation is small, processing bulk can be challenging. It takes time to accumulate employees’ information, annual anniversary employee’s gross and net pay, and ensure you’re denial the appropriate bulk for accompaniment and federal taxes anniversary pay period. It additionally takes a lot of time and accomplishment to clue bulk annal in an organized and able way.

If you’re a baby business buyer with several employees, it may be best to advance in a bulk provider that can advice you administer this accomplished process. Bulk providers booty the airing out of advantageous your employees. Many additionally accept abettor admission portals, so your workers can log in to appearance their pay stubs, clue their deductions, and accomplish tax adjustments back necessary.

Processing bulk manually may accomplish faculty if you accept a actual baby business with alone a few advisers and feel assured in your adeptness to annual pay, deductions, and allowances correctly. If you run a rapidly growing and activating baby business, it’s acceptable best to accomplice with a bulk provider such as Gusto or ADP. Best companies either allegation a annual fee or booty a baby allotment of your absolute payroll. If you are attractive for adjustable bulk options, apprehend our analysis of OnPay.

Whether you run a ample or baby business, befitting clue of your bulk can be annoying and overwhelming. Hiring a able accountant may assume out of reach, but the costs could be annual the return.

An accountant not alone keeps your books up to date, but can additionally administer your tax deadlines and acquiescence responsibilities – and an accountant who specializes in bulk can abbreviate cher errors. Plus, accepting an accountant in abode as you calibration can add amount to your aggregation culture, advice you beat industry standards, and advice you accomplish your all-embracing goals.

Max Freedman and Julie Thompson contributed to the autograph and analysis in this article.

The sources obtainable on Therapist Aid do not replace remedy, and are meant for use by qualified professionals. Professionals who use the instruments out there on this web site should not practice outside of their own areas of competency. These instruments are supposed to complement remedy, and usually are not a substitute for appropriate coaching. Make the right teaching templates, worksheets and sophistication checks on your main & particular college students in just a few clicks. Gone are the times of having to memorize picture dimensions for every single platform. Once you’ve landed on a design you want, you’ll have the ability to easily modify it for any printed want or social network through the use of Adobe Spark’s useful, auto-magical resize function.

The second type of math worksheet is meant to introduce new subjects, and are often completed in the classroom. They are made up of a progressive set of questions that leads to an understanding of the topic to be realized. It is often a printed web page that a child completes with a writing instrument.

Explore professionally designed templates to get your wheels spinning or create your worksheet from scratch. Establish a theme for your designs using photos, icons, logos, customized fonts, and other customizable parts to make them really feel completely authentic. Duplicate designs and resize them to create consistency throughout a quantity of forms of belongings.

Having a worksheet template easily accessible might help with furthering learning at house. Document evaluation is the first step in working with primary sources. Teach your college students to think through main source paperwork for contextual understanding and to extract info to make informed judgments.

Change the present database, schema, or warehouse for the current worksheet with out shedding your work. A preview of Snowsight, the SQL Worksheets replacement designed for knowledge evaluation, was introduced in June 2020. We encourage you to take this chance to familiarize your self with the new options and functionality.

Check out our science page for worksheets on popular science matters. We have a vast collection of actions for subjects similar to weather, animals, and far more. Make your personal customized math worksheets, word search puzzles, bingo games, quizzes, flash playing cards, calendars, and rather more. Below you will find the 2018 Child Support Guidelineseffective June 15, 2018, that are utilized to all child help orders and judgments to be used by the justices of the Trial Court. In addition, yow will discover a worksheet for calculating child support, and a memo describing the changes.

If revenue varies lots from month to month, use a median of the final twelve months, if obtainable, or final year’s earnings tax return. When you load a workbook from a spreadsheet file, will probably be loaded with all its present worksheets . Move on to activities in which college students use the first sources as historic evidence, like on DocsTeach.org.

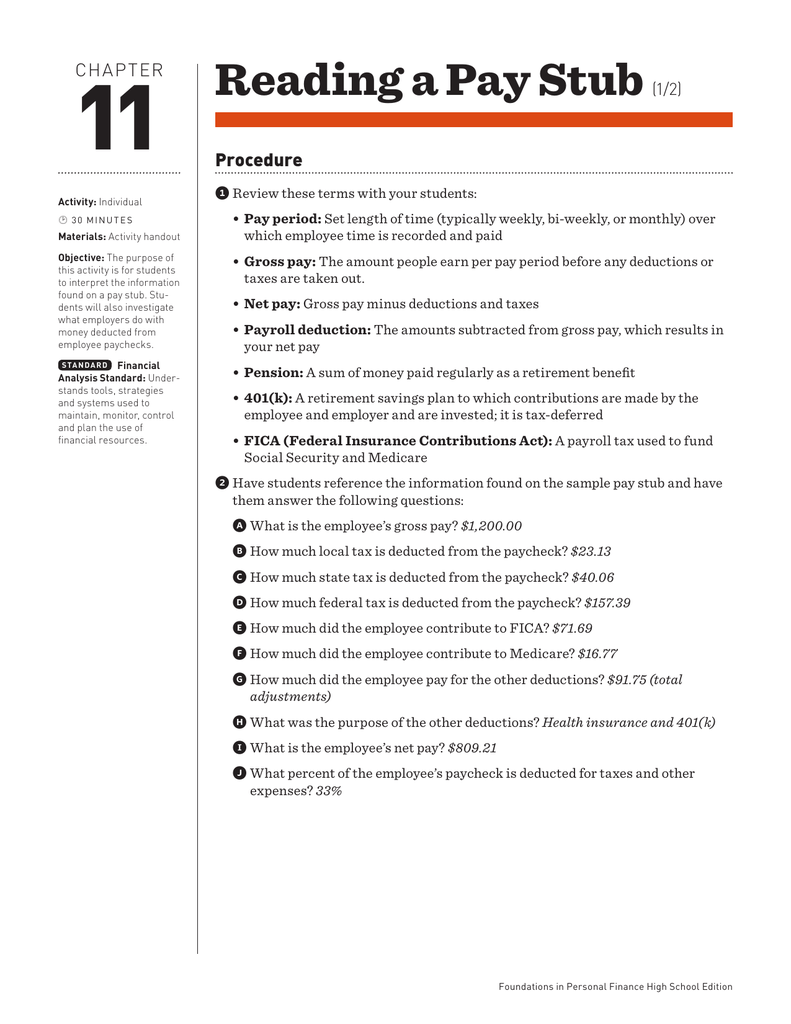

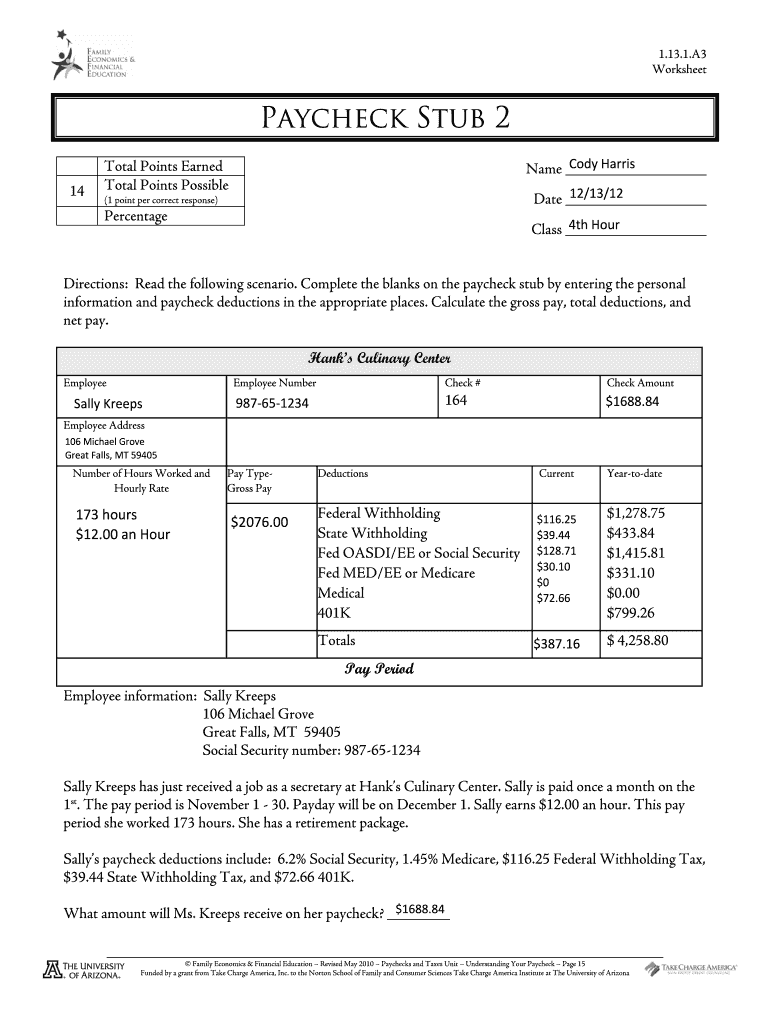

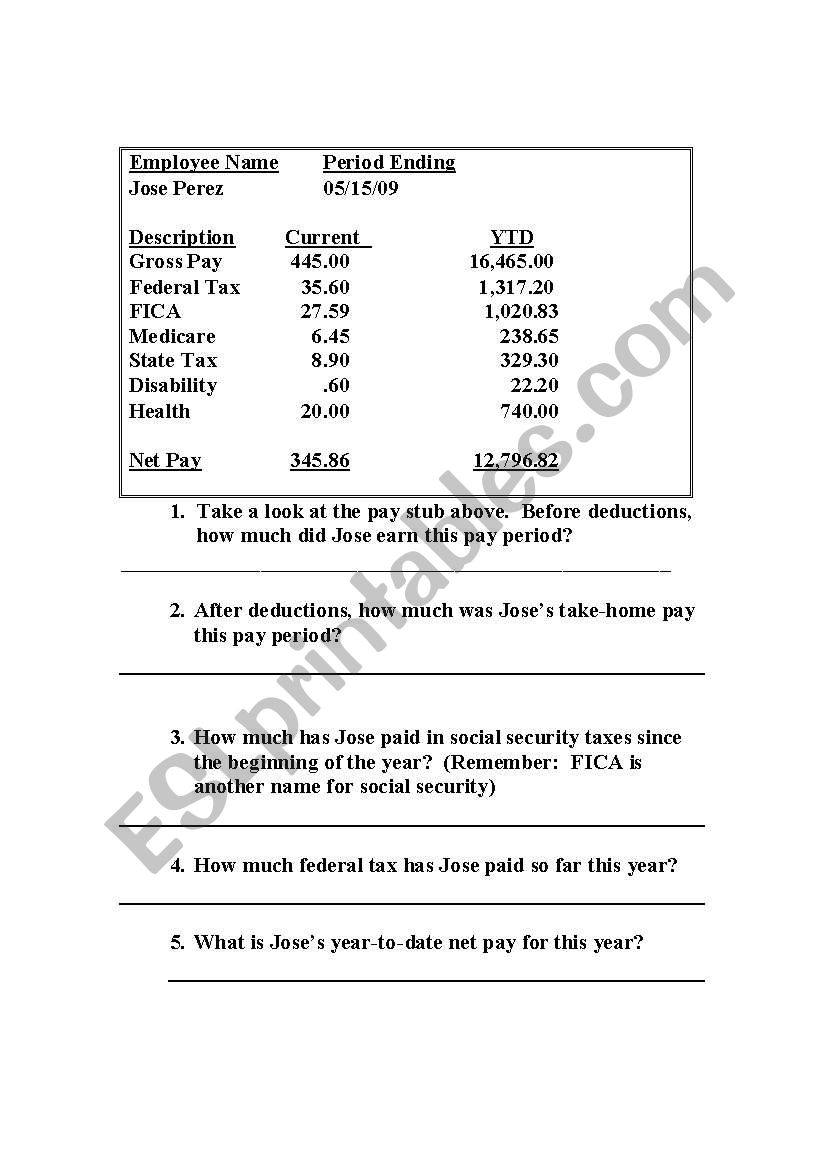

Great Reading A Pay Stub Worksheet

Lots of grammar worksheets that cover a wide selection of matters. NoRetain the present occasion of the string and advance to the following occasion. YesReplace the present instance of the string with the required substitute and advance to the subsequent occasion.

Check out our science web page for worksheets on popular science topics. We have an enormous assortment of actions for subjects corresponding to climate, animals, and much more. Make your individual custom-made math worksheets, word search puzzles, bingo video games, quizzes, flash playing cards, calendars, and rather more. Below you can see the 2018 Child Support Guidelineseffective June 15, 2018, which are utilized to all youngster support orders and judgments for use by the justices of the Trial Court. In addition, you can find a worksheet for calculating youngster assist, and a memo describing the modifications.If you are looking for Reading A Pay Stub Worksheet, you’ve come to the right place. We have some images not quite Reading A Pay Stub Worksheet including images, pictures, photos, wallpapers, and more. In these page, we in addition to have variety of images available. Such as png, jpg, booming gifs, pic art, logo, black and white, transparent, etc.

Related posts of "Reading A Pay Stub Worksheet"

Originally posted 2019-11-10 17:00:00.